Government borrowing for April-June was more than double that for the whole of the previous fiscal year thanks to the “unprecedented impact” of the COVID-19 pandemic, official figures show.

The deficit of £127.9bn for the three-month period compares with a £55.4bn shortfall for the year to the end of March, the Office for National Statistics (ONS) said.

For June alone, the government borrowed £35.5bn, about five times more than in the same month last year and the third highest monthly figure on record.

But it was lower than expected by economists and less than in May.

The ONS said: “The substantial increases in borrowing in recent months reflect the emerging effects of government coronavirus policies.”

However, the report also carried a warning that the figures were subject to greater than usual uncertainty due to the pandemic.

The figures come as Chancellor Rishi Sunak announces inflation-beating pay rises for doctors, teachers, police officers and other public sector employees.

But as he launched a comprehensive spending review, due to be concluded later in the year, he also warned that there

would have to be restraint in future public sector pay rises with “tough choices” ahead.

The Institute for Fiscal Studies think tank responded to the announcement by warning that “non-priority” government departments faced budget cuts compared to the pre-crisis settlement that was outlined in early March given the focus on coronavirus recovery.

The government has already announced extra spending and tax cuts worth around £192bn for the current financial year, including a £30bn “plan for jobs” revealed earlier this month.

Responding to the borrowing data, Mr Sunak said: “It’s clear that coronavirus has had a significant impact on our public finances, but we know without our response things would have been far worse.

:: Listen to The World Tomorrow on Apple podcasts, Spotify, Google podcasts and Spreaker

“The best approach to ensure our public finances are sustainable in the medium-term is to minimise the economic scarring caused by the pandemic.”

The ONS figures showed that Britain’s debt pile grew to £1.98trn in June, representing 99.6% of gross domestic product (GDP) – the highest level since 1961.

But that was lower than the 100.9% previously pencilled in for May after the ONS updated its estimate of GDP.

Meanwhile, the ONS revised down its previous figure for borrowing in May by £9.8bn to £45.5bn, mainly because tax receipts were stronger than had been estimated.

Governments have to borrow each month when expenditure is higher than receipts.

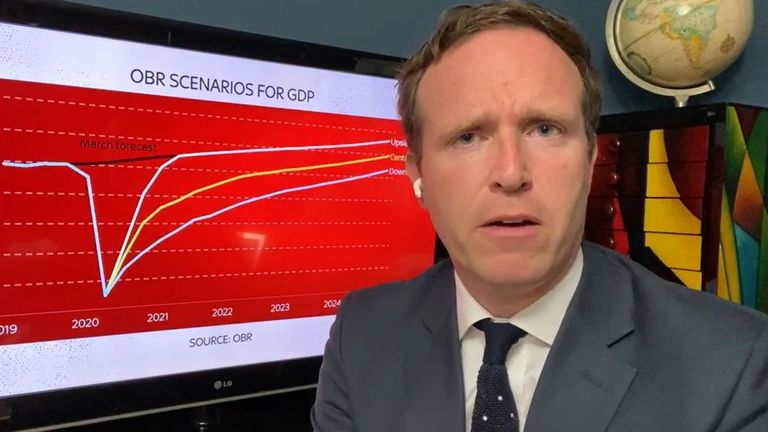

Borrowing is expected to reach £322bn in the current fiscal year to the end of March 2021, according to the central scenario outlined by the Office for Budget Responsibility (OBR) – or 16% of GDP, its highest level since the Second World War.

In June, receipts were 16.5% lower than in the same month last year at £49.4bn as tax revenues plummeted – notably VAT, which fell 45.1%.

Meanwhile, spending was up 24.8% year-on-year to £80.5bn, with £9.7bn of the extra outlay spent on furlough schemes subsidising temporarily laid-off workers.

Separately, latest figures from the Treasury on Tuesday showed its total spending on the schemes – including those covering both employees and the self-employed – had reached £36.5bn so far.

Reacting to the borrowing figures, Jeremy Thomson-Cook, chief economist at Equals Money, said: “The good news is that June’s number is £10bn lower than May’s revised figure, the bad news remains the obvious increase in the UK’s debt burden.

“In the short term however, the latter really does not matter; if your house is on fire you do not tell the fire brigade to only use a certain amount of water.”