Unpaid household bills built up during lockdown will lead to a spiral of debt for many unless financial support is provided, according to Citizens Advice.

One in nine people have reported being unable to keep up with household bills – the equivalent of six million individuals across the UK, according to research by the charity.

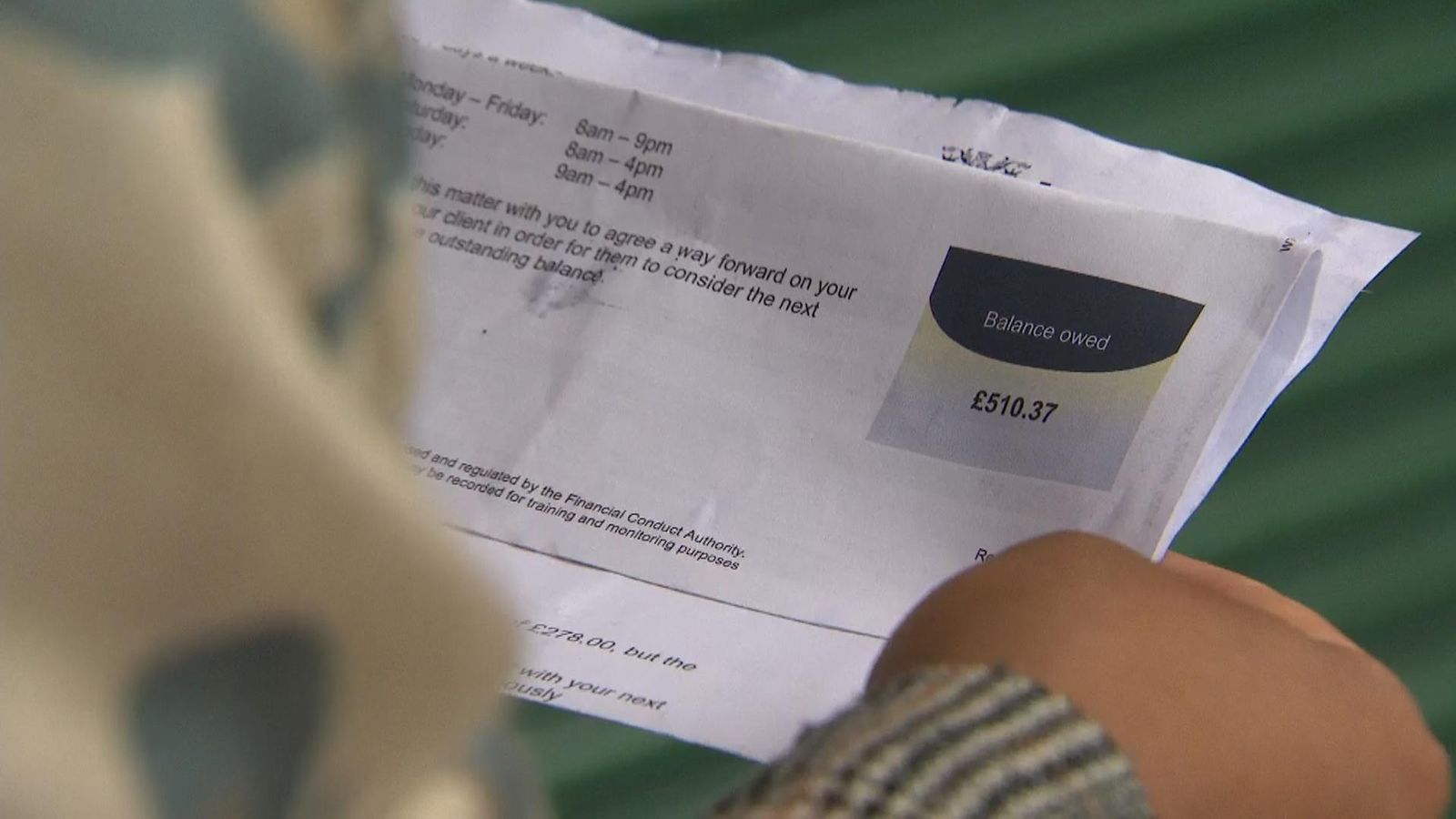

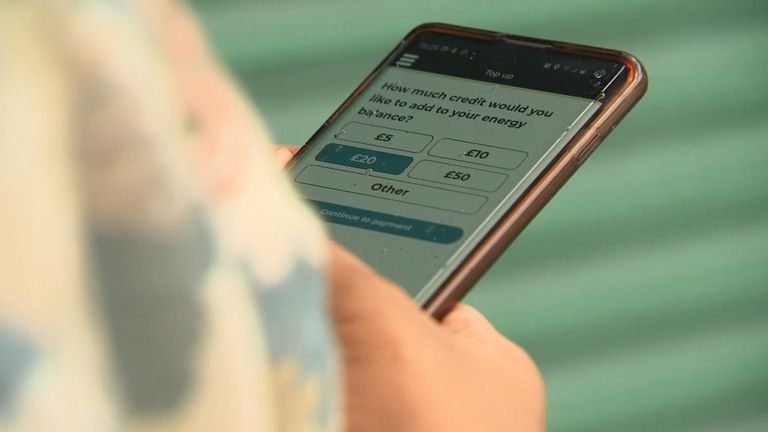

“Laura”, who wants to remain anonymous, had been working hard to clear her debts before the pandemic, but a health condition meant she couldn’t carry on in her new job and she was told she wouldn’t be furloughed.

“I was managing and then this has put me back to square one,” she said.

“When you are in your overdraft and you are borrowing money… it does put you in a circle where, when you get paid again, you have got to pay that off and it starts over again.”

She has fallen behind on her council tax and phone bill as well as other debts and is now working double shifts to get back on her feet.

“It makes you feel worthless when you can’t even take your children out for a nice day. It got me upset and stressed.”

The survey revealed that one in four people, who are parents or carers, have fallen behind on their household bills as well as one in five key workers.

And one in five of those made to shield, meaning they need to stay at home due to a health condition, have also missed payments.

Of the six million struggling to pay the bills, one in 10 have been unable to afford food and one in five have sold possessions to make ends meet.

It doesn’t help that measures designed to help protect income during lockdown are coming to an end.

But Laura feels she’s fallen between the cracks when it comes to receiving support.

“I feel there is help out there for some people but you have got to fall into the right category… and if you don’t, it’s really hard to cope.”

Katie Martin, director of external affairs for Citizens Advice, says the economic impact of coronavirus is not being felt equally.

“It’s often those that were struggling most before the crisis that are struggling now,” she said.

“We are urging the government to take some action to make sure people can recover from these debts quickly and get back on the road to recovery as the economy recovers.”

She said she thinks the cost could be shared between the government, creditors and the individuals where possible.

“We don’t think it should be handout. We think there could be interest-free loans where appropriate but that is really something we need to work through and see what’s right for different areas.”

She also says it’s crucial that people don’t wait to seek help.

“The most important thing is that people take action really, really quickly.

“Talking to the people you owe money to, you can often arrange repayment plans or reduced amounts. That’s the most important thing – that you don’t pretend it’s not happening.”