In ordinary times chancellors and prime ministers would trade a limb for a monthly increase in GDP of 6.6%, but these are far from normal days and there are already signs that the post-lockdown bounce back may be losing some of its zip.

The positives first.

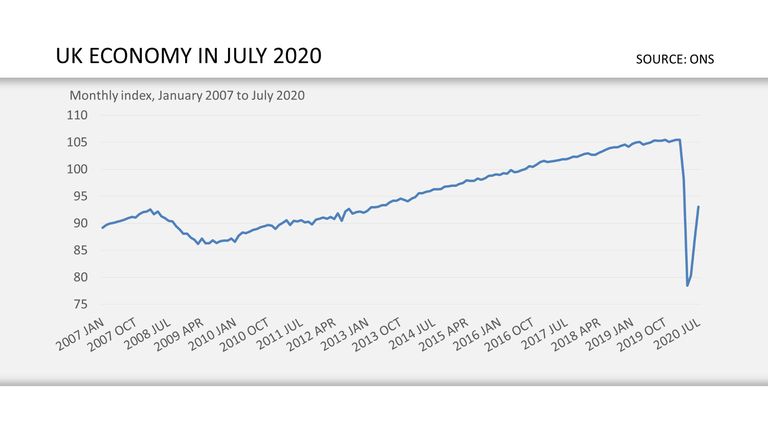

The recovery in July continues the V-shaped trajectory established in June, and after the cliff-edge descent of a record 20% fall in the second-quarter it is at least heading in the right direction.

But July’s growth is less than the 8.7% in June, suggesting the elastic of the COVID-19 bounce-back may already be approaching its limits.

Much of the recovery since the dog days of April can be attributed to the easing of lockdown restrictions. Bricks and mortar retailers reopened in June, and in July pubs and restaurants returned, albeit with distancing reducing capacity and anxiety capping demand.

:: Subscribe to the All Out Politics podcast on Apple Podcasts, Google Podcasts, Spotify, Spreaker

With those two major sources of consumer spending back in business, the economy is still 11.7% smaller than it was pre-lockdown and the question the Treasury may be asking is where the rest of the recovery will come from.

Chunks of the economy still remain closed including nightclubs, theatres, concerts, events and sports grounds, and city centres still have a post-apocalyptic feel with daytime footfall still down more than 80%.

Until all sectors are open and the economy is operating round-the-clock we may not be able to judge just how real or resilient the recovery is, but dancing and dining are unlikely to fill the hole.

With the furlough tap due to be turned off in October (and despite mounting pressure the Chancellor maintains it will end) an unemployment wave is coming and it may sweep away consumer confidence as well as hundreds and thousands of jobs.

And we are yet to see what impact the new “clearer” restrictions set out in the rules of six do to people’s appetite for socialising in public.

Nor will the UK, for all its reliance on services, eat and drink its way out of recession.

The construction industry performed best of all sectors in July but is still 11.6% down on pre-lockdown levels, likewise manufacturing at -8.7%.

The chancellor’s response to the latest figures was a rote list of measures, many of them hugely welcome, the government has taken so far, including the KickStart scheme to help the young unemployed and the job retention bonus.

He, like the prime minister and the scientists advising them, still cannot be certain how far the pandemic has left to run, and our economic fate is still shaped most by health policy.

But continuing growth and restoring confidence may need more than a boilerplate list of the story-so-far from No 11.