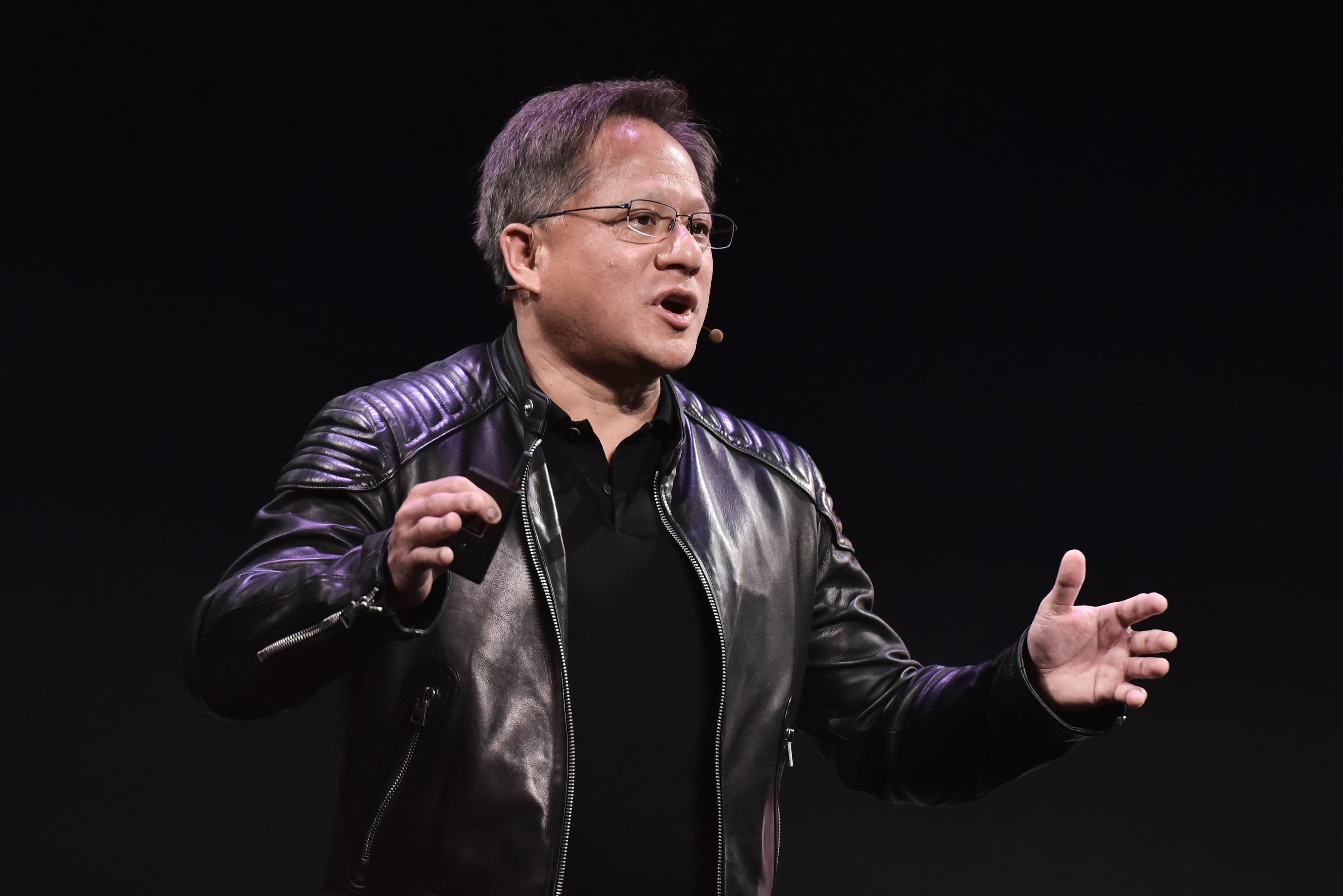

Nvidia CEO Jensen Huang wearing his usual leather jacket.

Getty

LONDON – Regulators in China could be a major barrier in Nvidia’s attempt to buy U.K. chipmaker Arm from SoftBank for $40 billion, according to analysts.

The mega-deal, which would create the largest chip company in the West by market value and global reach, was announced at the start of September. But it is far from being home and dry, with multiple regulators able to weigh in including China’s Ministry of Commerce (MOFCOM) and China’s State Administration for Market Regulation (SAMR).

“Technically, Beijing can block the deal,” Abishur Prakash, a geopolitical specialist at the Center for Innovating the Future, a Toronto-based consulting firm, told CNBC by email.

It wouldn’t be the first time Chinese regulators have prevented a U.S. chip firm from buying a European player. In 2018, SAMR blocked Qualcomm’s attempt to buy Dutch chipmaker NXP.

Bill Ray, a senior director analyst at research firm Gartner, told CNBC by email that Chinese regulators “will seek to extract specific guarantees before granting approval.”

He added that “some of these guarantees may be beyond the ability of Nvidia to provide,” specifically calling out the ongoing provision of Arm’s intellectual property (IP) to Chinese businesses.

Ray believes Nvidia will likely try to assure Chinese regulators by saying Arm’s technology is British and that future investment in the U.K. will ensure it stays that way. But it’s not that straight forward.

“Provision to China should not be an issue.” he said. “However, this neglects the influence that the U.S. has on the U.K., and the ability of the U.S. administration to influence companies outside its obvious jurisdiction.”

Geoff Blaber, a vice president of research at analyst firm CCS Insight, said: “It should be no surprise that China is expected to be a high hurdle for regulatory clearance.”

“China’s tech industry has been built on Arm so it has a vested interest in the status quo, particularly when the proposed scenario is ownership by a U.S. company,” Blaber added. “Regulatory scrutiny is inevitable, and the ownership structure of Arm Technology China adds further complexity.”

MOFCOM, SAMR and the Chinese embassy in London did not immediately respond to CNBC’s request for comment. Nvidia declined to comment while a spokesperson for Arm said: “Nvidia, Arm and SoftBank are confident that all regulatory approvals will be secured.”

Britain’s tech hero

Arm is widely regarded as the jewel in the crown of the British tech industry. Its energy-efficient chip architectures are used in 95% of the world’s smartphones and 95% of the chips designed in China.

The Cambridge-headquartered firm has a joint venture called “Arm China” with Chinese private equity firm Hopu Investments. Arm China is headquartered in Shanghai, meaning China’s regulators will have the right to review the proposed Nvidia deal.

China’s chip industry has urged Beijing to investigate the deal, warning that it will hand the U.S. control over a key technology that is used in almost all of the world’s phones.

Zhu Jing, the vice-chairman of the Beijing Semiconductor Association, said a U.S. company could not be trusted with ownership of Arm.

“Look at how the U.S. is treating Huawei,” he told The Paper, a Chinese digital publication owned by the state, in September. “If Arm is acquired by a U.S. company, everyone will be worried.”

Lawmakers in Washington have been clamping down on Huawei for years, claiming the firm is a threat to national security. In May, the U.S. introduced new export controls on Huawei that are designed to restrict the company’s access to chips made with U.S. equipment. The following month, the U.S. included Huawei on a list of 20 Chinese firms that are allegedly owned or controlled by the Chinese military.

The Global Times, another state-owned newspaper, also urged Beijing to intervene. “The possibility that Arm could be politicized as a US technology weapon against China’s technology companies must be taken seriously,” an editorial warned around the same time.

Chinese chip designers, including Huawei’s HiSilicon chip design division, are worried about losing access to Arm’s IP after the Nvidia deal, according to The Financial Times. “Will it still find a way to provide us with IP after being acquired? I have to say I’m a bit worried,” one HiSilicon chip designer, who asked not to be named, reportedly said. Huawei declined to comment.

Not just China

The deal will also be scrutinized by governments and regulators in Europe, the U.S. and the U.K. Earlier this month, two U.K. tech investors said they expect the deal to be blocked by someone.

Opposition to the deal has been particularly strong in the U.K., with Arm co-founder Hermann Hauser leading the attack, calling it an “absolute disaster” for Cambridge, the U.K. and Europe. His primary concerns, which are shared by a handful of British lawmakers, are that Nvidia could relocate Arm’s headquarters or reduce the size of Arm’s workforce at some point in the future.

He’s also said Nvidia will “destroy” Arm’s business model, which involves licensing chip designs to around 500 other companies including several that compete directly with Nvidia, and that the deal will create a monopoly.

The chief executives of Nvidia and Arm spoke about the deal at last week’s Arm DevSummit.

Nvidia CEO Jensen Huang said he and Arm are confident the deal will go through. “And the reason for that is because as soon as we explain the rationale of the transaction and our plans, the regulators, around the world will realize that these are two complementary companies,” he said on Tuesday.

“We’re going to protect the business model, we’re going to create, continue to nurture this neutral, committed, consistent, trusted platform, so that our ecosystem can continue to flourish and even grow.”

Arm CEO Simon Segars said: “There’s a process to go through. It’s absolutely the right thing that the process is done thoroughly. But I think we’re going to get to the end of that. Everyone’s going to realize that this is a good thing for expanding and that we’ll get approval.”