David Cameron has been in the headlines recently over his alleged involvement in a lobbying scandal with a firm he advises and the Treasury.

Sky News has broken down what is going on, who the key players are, and why the former prime minister is under fire.

What did David Cameron do?

Mr Cameron approached a number of government ministers on behalf of Greensill Capital – a financial services firm he started working for in 2018. He was trying to secure Greensill access to a loan scheme called the Covid Corporate Financing Facility (CCFF). The former prime minister wanted Greensill Capital to be able to issue loans using tax-payer cash through this scheme. According to newspaper reports, Mr Cameron stood to make millions of pounds through his share holdings in the firm.

Who did he approach?

Mr Cameron sent multiple text messages to the personal phone of the Chancellor Rishi Sunak and approached two junior treasury ministers. According to the Sunday Times, the former prime minister also sent an email to a senior Downing Street adviser saying it “seems nuts” to exclude companies like Greensill from the scheme.

Was he successful?

The proposals from Greensill Capital were ultimately rejected by the Treasury and the firm was not given access to the CCFF scheme. However the firm was allowed access to tens of millions of pounds of tax-payer cash to issue loans under a separate pandemic support scheme known as the Coronavirus Large Business Interruption Loan Scheme (CLBILS).

But did Mr Cameron’s influence get the firm special access?

It’s hard to say. Text messages sent by Mr Sunak to Mr Cameron show the chancellor said he “pushed” his team to examine Greensill’s proposals. Official records also show that representatives from Greensill had 10 meetings with Treasury officials in just over three months last spring. Minutes from one of those calls reveal the conversation was taking place “at the Chancellor’s request”. Treasury sources say it is right they look at all proposals and were unaware of Mr Cameron’s “it seems nuts” email at the time it was sent.

Subscribe to the Backstage podcast on Apple Podcasts, Google Podcasts, Spotify, Spreaker

Did Mr Cameron do anything wrong?

The former prime minister was cleared of any wrongdoing by the official watchdog in March 2021 on the basis that he was an employee of Greensill Capital rather than a third-party lobbyist. He joined Greensill more than two years after leaving office, meaning he didn’t have to clear the role with a specialist vetting committee. Critics say Mr Cameron has got off on a technicality and there should be stronger rules to increase transparency in this area.

Did Mr Cameron approach any other cabinet ministers?

Yes. In October 2019 he went for a “private drink” with Lex Greensill – the founder of Greensill Capital – and Health Secretary Matt Hancock. They discussed a payment scheme that the firm wanted the NHS to start using.

Was the payment scheme used by the NHS?

Yes. It was used in parts of the health service. But allies of the health secretary say everything was above board and he “updated officials on the business that was discussed” in the October drinks meeting. Advice was also commissioned from civil servants on the payment scheme when it was first put forward in August 2019. Sources say Matt Hancock was clear that other providers should be able to offer the work as well.

Who is Lex Greensill?

Lex Greensill is a billionaire Australian financier who initially worked for multinational banks before founding Greensill Capital in 2011. The firm specialised in “supply chain finance” – a service designed to let companies have their bills paid more quickly through the use of short term loans. He was awarded a CBE for “services to the economy” in 2017.

Did Mr Cameron know Mr Greensill when he was prime minister?

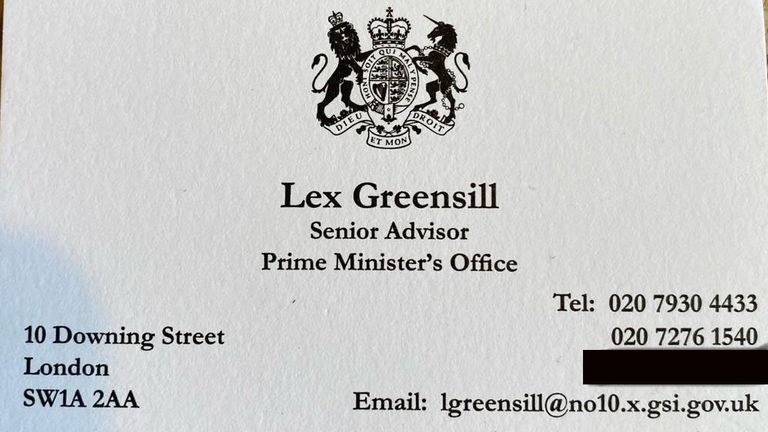

Yes. In fact a business card published by the Labour party suggests Mr Greensill was a “senior advisor” to Mr Cameron while he was in Downing Street. At the time, Mr Greensill was instrumental in setting up a payment scheme for pharmacies that was based on his firm’s ‘supply chain finance’ model. Greensill Capital began providing funding to pharmacies through this scheme in 2018.

What has happened to Greensill Capital?

The firm went into administration in March this year with the loss of 440 jobs. Thousands of further jobs are also potentially at risk in companies Greensill lent money to, including GFG Alliance – the owner of Liberty Steel. Before going into administration, Greensill Capital was stripped of a government guarantee to provide loans through CLBILS for breaching the terms of the support scheme.

Why does this matter?

It matters because the private companies the government works with often stand to make a lot of money from the state. Rules about procurement are intended to make it a levelling playing field for firms to bid for public sector contracts. But there are concerns that former-politicians can use their influence and connections in Westminster to get priority access for companies they stand to benefit from. Mr Cameron warned of this issue while he was prime minister, predicting that lobbying was set to become “the next big scandal”.