If the Colonial Pipeline is not back in business by the weekend, prices could continue to rise at the pump and there will be broader localized fuel shortages across the southeast and mid-Atlantic regions.

Gasoline stations that could not get enough fuel were already closed in some states, and prices jumped overnight, by as much as 10 cents or more per gallon in some areas.

“This turns into a crisis by the end of the week, if it’s not resolved, particularly with Memorial Day coming,” said John Kilduff, founding partner of Again Capital. “People are going to start topping off their tanks.”

It’s not that there’s not enough fuel. There’s plenty in the refining centers on the Gulf Coast.

The issue is that gasoline, jet fuel and diesel are stuck in the wrong places. Moving it requires a hodgepodge of solutions, and analysts say it will be impossible to meet demand without the pipeline.

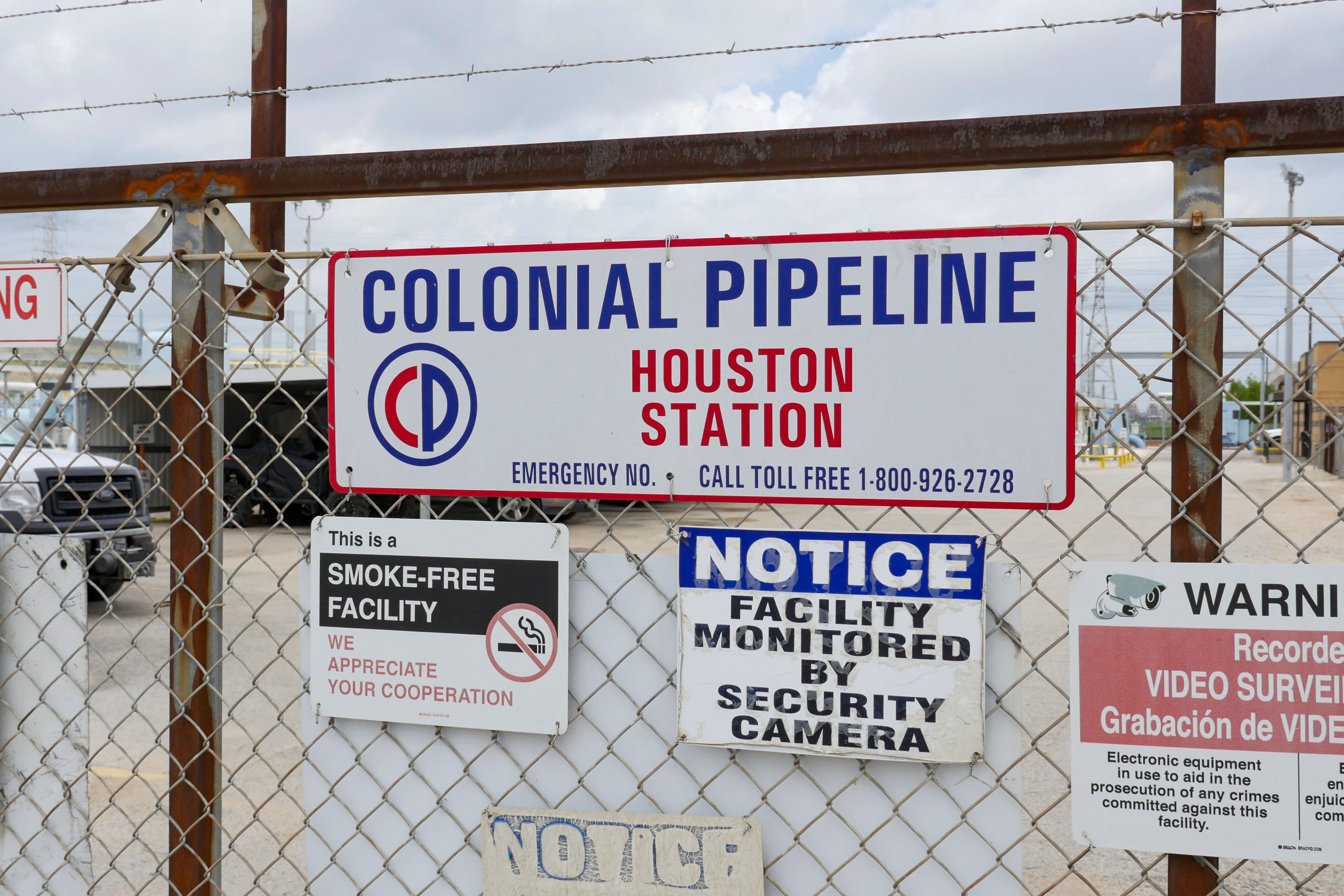

Colonial Pipeline attack

Colonial Pipeline stopped operations Friday and notified federal officials that it was the victim of a ransomware attack. The attack, carried out by a criminal cyber crime group known as DarkSide, resulted in the shutdown of 5,500 miles of pipeline. The artery supplies half of the gasoline to the east coast and runs from Texas to New Jersey.

The pipeline company said it expects to restore a substantial amount of operations by the end of the week, but how much is not clear. U.S. Energy Secretary Jennifer Granholm said federal agencies are working around-the-clock to help the pipeline return to normal operations.

The shutdown arrives at an inopportune time: The beginning of what could be a record summer driving season as Americans make up for last year.

“Given the size and the direction of the pipeline and the market that it feeds, the Colonial Pipeline is the single most important artery moving refined products in the country,” said Michael Tran, energy analyst at RBC. “This is already an earthquake and the magnitude of the earthquake just grows by the day.”

Prices inch upward

The national average for a gallon of unleaded gasoline jumped to $2.985 Tuesday, an increase of 6 cents in the past week, according to AAA.

Regionally, however,the price increases were sharper, AAA found. In South Carolina, for instance, gasoline prices were up more than 6 cents since Monday and 13 cents in the past week. In Georgia, drivers were paying $2.87 per gallon Tuesday, an increase of of more than 10 cents in just one day and 17 cents in a week.

A rise of 3 more cents per gallon would put the average U.S. selling price at the highest level since November 2014.

“We are seeing the full fledge panic at the moment in some of the places I suspected we might see it,” said Tom Kloza, head of global energy analysis at OPIS. “There aren’t enough drivers to take trucks from terminals that have gasoline to stations. We are seeing a lot of stations running out. Georgia seems to be ground zero.”

Kloza said he expects gasoline prices to rise, but not spike wildly higher. The bigger issue is that gasoline will be in short supply in the region, since it takes time to replace once the pipeline is switched on and outages could continue.

Gasoline in the pipeline travels at just 5 miles per hour.

This turns into a crisis by the end of the week, if it’s not resolved, particularly with Memorial Day coming.John Kildufffounding partner of Again Capital

According to GasBuddy, 7.6% of the gas stations in Virginia were out of fuel Tuesday afternoon, while 7.5% of stations in North Carolina have run dry. The impact on gas stations in other states along the pipeline was lower though 5.2% of Georgia stations were out of fuel.

GasBuddy also notes that gasoline demand on Monday in five key southeastern states was 40.1% greater than it was on the prior Monday. Those states are Georgia, Florida, South Carolina, North Carolina and Virginia.

“Gasoline demand as a whole was up 20%” for the U.S. on Monday, according to Patrick De Haan, head of petroleum analysis at GasBuddy. De Haan said for each day the pipeline is down, it takes five to seven days to return to normal.

“Refiners are starting to book tankers to store product off shore because it’s backing up in the system,” said Kilduff.

“You have a weird kind of problem,” he added. “U.S. Gulf Coast refinery operating levels are at record highs. They were over 90%. They have the opposite problem. There’s a surfeit of supply building in the Gulf Coast region.”

Some refiners, like Motiva, have already cut back runs.

Alternative ways to transport gas

Again Capital’s Kilduff said traders are watching to see if the U.S. will waive the Jones Act to allow non-U.S. ships to transport gasoline to U.S. ports.

Under the Jones Act, a U.S.-flagged ship must be used to transport goods from one U.S. port to another, but in an emergency, refiners could seek a waiver so they could ship fuel to the southeast ports.

The New York region could be spared the worst of it, since it is served by Philadelphia and New Jersey refineries, and there are increased shipments of gasoline from Europe already booked for the U.S,. said Kilduff.

“There’s bookings out of Europe to come to the U.S. That’s why we’re seeing pressure on gas prices,” said Kilduff, noting RBOB gasoline futures were barely higher. Futures had initially jumped on concerns about shortages, but had given back most of their gains. Jefferies noted that at least six tankers were booked to ship gasoline from Europe.

Currently, more fuel is being moved by truck. Truckers have been given temporary hours of service exemptions, but Kloza of OPIS said the problem of too few truckers is an issue for the effort. The lack of truckers had already been straining supply in some areas.

“To put it in perspective, if a tanker truck can hold 250 barrels of gasoline and the Atlanta area consumers need over 200,000 barrels of gasoline, you need more than 1,000 trucks a day,” said Andy Lipow, president of Lipow Oil Associates.

Lipow said that also doesn’t solve the supply problem for diesel-fueled trucks or the issue airlines face if they can’t get jet fuel. The pipeline carries 1.5 million barrels a day of gasoline and about 1.2 million barrels of distillates, which includes diesel and jet fuel.

“Jet fuel is a concern because it’s only stored at airports. They’re at risk of running out of jet fuels and airlines have to make alternative plans, loading up aircraft before they fly into those airports, making sure they have supplies before they go to their next destination,” Lipow said.

American Airlines said the impact so far was minimal, but that it was adding stops to two long-haul flights from Charlotte to conserve fuel at the North Carolina hub.

Become a smarter investor with CNBC Pro.

Get stock picks, analyst calls, exclusive interviews and access to CNBC TV.

Sign up to start a free trial today