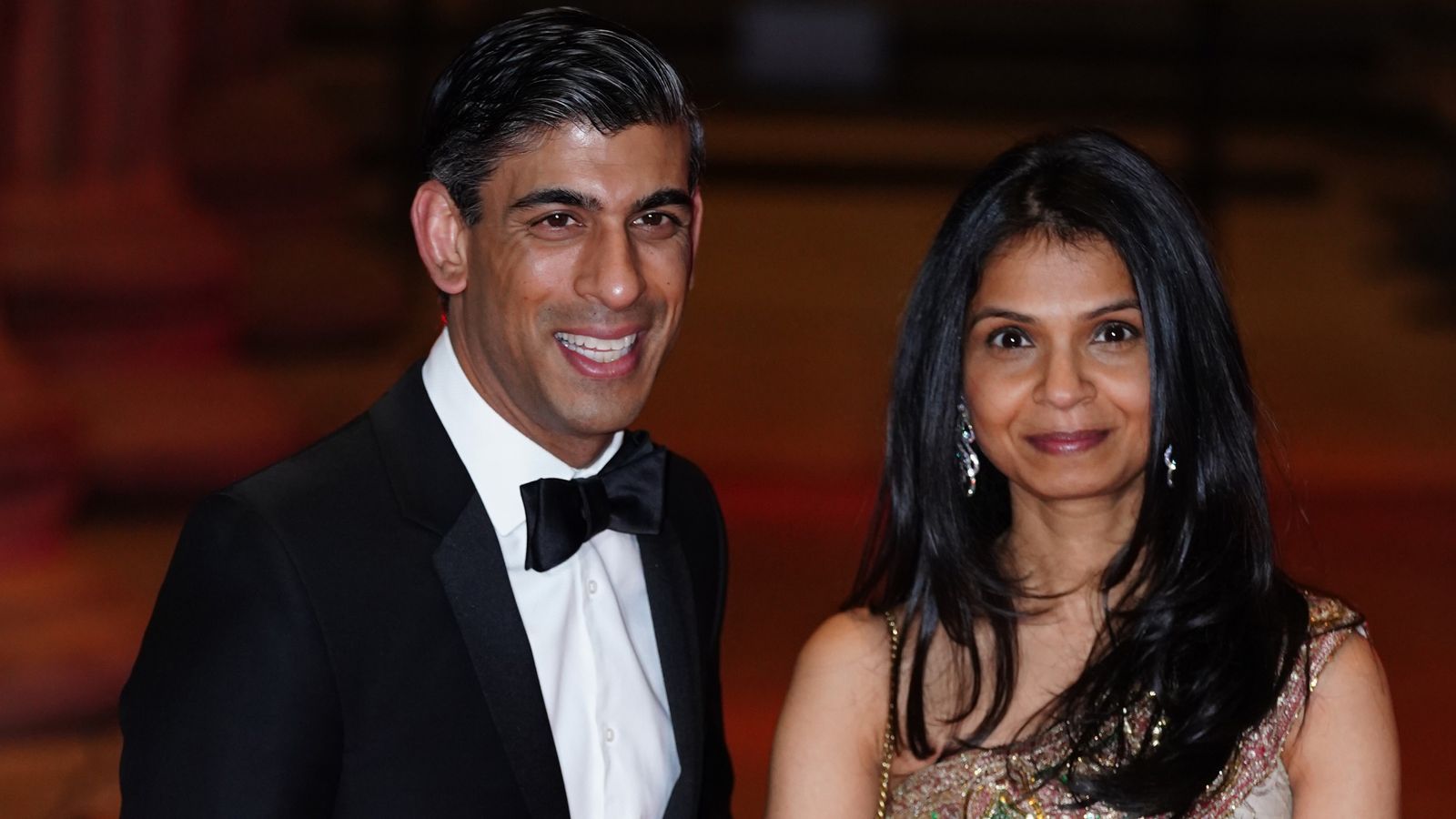

Chancellor Rishi Sunak has been forced to defend his wife’s tax affairs amid criticism her multi-millionaire status puts him out of touch with the current cost of living crisis.

Mr Sunak married Akshata, the daughter of the so-called ‘Bill Gates of India’ – Narayana Murty, in 2009 after they met at Stanford University.

Her 0.91% stake in her father’s tech empire Infosys brings her net worth to around £500m.

Read more: Sunak in most difficult period as chancellor – analysis

Labour says Sunak has ‘clear conflict of interest’ over wife’s non-dom tax rules

She lives at Number 11 Downing Street with Mr Sunak and their two daughters but is still an Indian citizen.

Reports she enjoys non-dom status, which means she does not have to pay UK tax on her international income, and that Infosys were still operating in Moscow despite the war in Ukraine, have seen Mr Sunak under fire in recent weeks.

In a newspaper interview the chancellor insisted his wife pays tax in all the countries she has business in and as a private citizen her financial affairs should not be up for public debate.

Here Sky News takes a closer look at Akshata Murty, her family’s wealth and how it is affecting her husband’s political career.

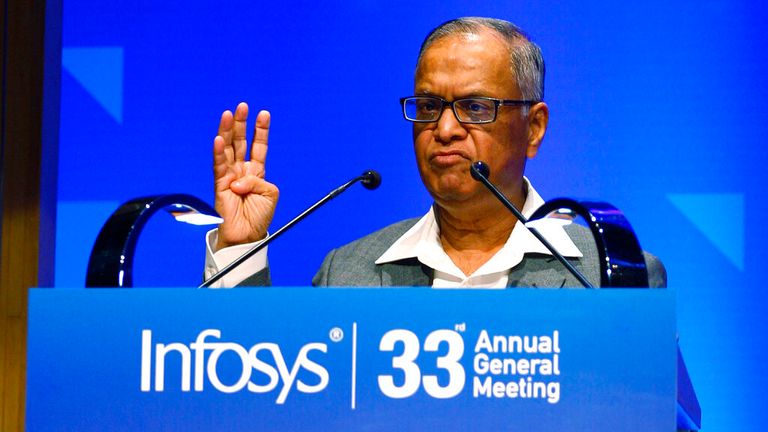

Daughter of the ‘Bill Gates of India’

Akshata Murty was born in 1980 to parents Narayana and Sudha Murty in the southern Indian state of Karnataka.

Her parents initially took her and her brother Rohan with them when they moved to Mumbai for work – but soon decided to send them back to Karnataka to live with their paternal grandparents.

It was a year later in 1981 that her father founded Infosys, the company that would go on to make him one of the richest men in India.

After his master’s degree in electrical engineering and one failed IT business, Mr Murty borrowed 10,000 rupees (£100) from his wife to set up the new firm.

In a matter of years Infosys had created a global delivery model for outsourcing IT services from India, making the company millions.

Mr Murty served as CEO until 2002 when he took on the role of chairman, before stepping back to a role of chairman emeritus.

Forbes puts his net worth at $4.5bn (£3.45bn), while Time magazine refers to him as the “father of India’s IT sector”.

Mrs Murty, a computer scientist and engineer, who was the first woman to work for India’s largest carmaker, has also worked for Infosys, and is now a philanthropist and member of the Gates Foundation.

Met Rishi Sunak at Stanford

After completing her schooling in India, Akshata travelled to the US to study economics and French at the private Claremont McKenna College in California.

She then moved to Los Angeles to study design and merchandising at the Fashion Institute of Design.

After stints at firms including Deloitte and Unilever she went to Stanford to study for an MBA.

It was there she met Rishi Sunak in 2005.

Four years later they got married in a two-day ceremony in Bangalore where the guestlist included several of India’s top cricketers.

The same year she founded her own fashion brand Akshata Designs, which saw her featured in Vogue in 2011.

Despite having her own business, it is her share in Infosys that makes up most of her wealth, which is estimated at £500m – higher than the Queen’s.

She is also the director of the venture capital business Catamaran Ventures UK, which her father started in 2010.

Her husband was a co-owner, but transferred his shares to her shortly before being elected as the Conservative MP for Richmond in 2015.

Akshata meanwhile, is listed as having shares in at least six other UK companies, including luxury gentlemen’s outfitters New & Lingwood and the UK company that operates Jamie’s Italian in India, nanny agency Koru Kids and gym chain Digme Fitness, which she is also a director of.

She and her husband have four homes, including a £7m five-bedroom property in Kensington, one on London’s Old Brompton Road, a £1.5m mansion in his North Yorkshire constituency, and a Santa Monica penthouse in California with an estimated value of £5.5m.

They have two daughters, Krishna and Anoushka.

Husband under fire

Following widespread praise for his furlough scheme during the coronavirus pandemic, Rishi Sunak was touted as a potential successor to Prime Minister Boris Johnson.

Mr Johnson’s involvement in the ‘partygate’ scandal and investigation by the police for gatherings held across Downing Street and Whitehall during COVID lockdowns, heightened interest in who could replace him as PM.

But questions over his wife’s family’s vast wealth have appeared to hinder his chances in recent weeks.

First it was reported that Infosys still had operations in Moscow, despite the UK, US and other Western allies unitedly pulling out of Russia in response to the war in Ukraine.

A spokesperson for the company later confirmed they would be replacing staff in Russia with others abroad.

This week the Independent reported that as an Indian citizen, Ms Murty has ‘nom dom’ status, which has previously been used for tax avoidances in the UK, sparking accusations of “breathtaking hypocrisy” by Labour leader Sir Keir Starmer.

In an interview with The Sun, Mr Sunak responded to the claims.

“Every single penny that she earns in the UK she pays UK taxes on, of course she does,” he wrote.

“And every penny that she earns internationally, for example in India, she would pay the full taxes on that. That is how the system works for people like her who are international who have moved here.”

There has also been criticism Mr Sunak’s spring statement failed to address the cost of living crisis, sparking claims that his own personal wealth means he is unable to fully comprehend the impact on families.

The Resolution Foundation think tank estimated that his package of measures would push 1.3 million people into poverty.

In response, Mr Sunak told Sky News he disagreed with the idea that “government can or should” compensate everybody for the resulting real-terms hit to their finances, especially when global factors such as the Ukraine war are at play.

He added: “My job is to make the right long-term decisions and my view is that an excessive amount of borrowing now is not the responsible thing to do.”