Just Eat Takeaway.com has downgraded its annual growth expectations while reporting a fall in orders during the first three months of its financial year, bolstering fears of a global consumer spending slowdown.

Europe’s largest meal delivery platform also revealed it had bowed to investor pressure on the future of Grubhub, the US business it bought last year for $7.3bn, saying it was considering a sale and was in talks with a number of potential buyers.

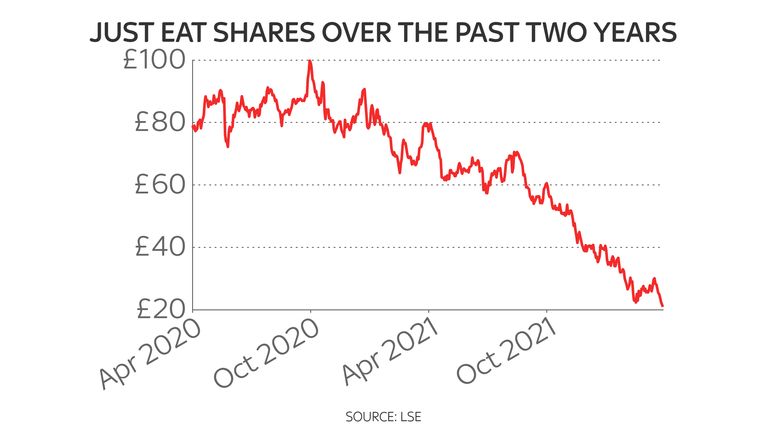

The group’s market value has taken a hammering since the deal completed in June – with shareholders in the sector concerned about post-pandemic momentum and tougher competition.

Shares – down 46% this year alone ahead of the first quarter trading update – fell 2.5% in early deals at the market open on Wednesday but later reversed course, with analysts crediting the Grubhub move.

However, the Just Eat stock remains around €26 a share, close to the 2016 flotation price of €23.

Just Eat told investors it now expected “mid-single digit growth” for its gross transaction value (GTV) this year – a measure the total value of food ordered and delivered – instead of the “mid teens” predicted just last month.

The slowdown is likely a consequence of economies continuing to awaken from COVID-19 restrictions but also the growing competition for consumer spending as households globally battle higher bills for things like energy and food.

The squeeze on households was reflected on Wall Street last night when Netflix shares slumped by up to a quarter on evidence people were tightening their belts, with subscriber numbers falling for the first time in a decade.

In the case of Just Eat, it reported 264.1 million orders across its global operations between January and March – a fall of 1% on the same period last year – with 67.6 million of those orders recorded in the UK and Ireland.

A total figure around 285 million had been predicted by some analysts.

Amid the slide in market value, Just Eat said it was “actively exploring the introduction of a strategic partner into and/or the partial or full sale of Grubhub”.

Efforts to boost profitability would include a focus on increasing revenue per order and cutting costs.

Chief executive Jitse Groen added: “Our priority for 2022 lies in … strengthening our business.

“We expect profitability to gradually improve throughout the year, and to return to positive adjusted EBITDA in 2023.”