Just six months ago, the economy was on the brink, with markets concerned that the UK would not be able to pay back its spiralling obligations. Debt costs were rising.

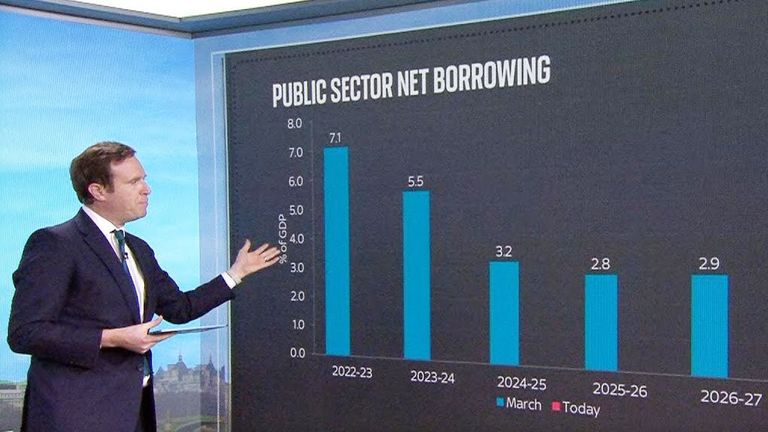

Yet fast forward to today, and Jeremy Hunt delivered another heavy spending budget – dolling out £21bn a year, funded by yet more borrowing, taking the chancellor to within a whisker of breaking his fiscal rules.

Meanwhile, one of the centrepiece measures – abolishing the limit of tax free pension savings – will help a tiny number of just the very richest.

It is the kind of measure that did such damage to the Truss administration in September, even if the scale is smaller.

The two biggest winners in today’s budget were companies who benefit from measures to soften the corporation tax rises by offering £9bn in tax breaks, and future working parents of one and two-year-old children who, by 2025, will be able to access 30 hours of free childcare a week.

However, the outlook on living standards still looks bleak, and there’s no end in sight when it comes to the issue blighting lives today – public sector strikes.

It will be interesting to see how quickly people feel the effects of today’s budget themselves.

The Office for Budget Responsibility has laid out the misery of the years to come.

Real living standards are expected to fall 5.7% between now and 2024 – the period until the next election.

While this is 1.4 percentage points less than the November forecast, this is still the largest two-year fall since records began in the 1950s.

That is a challenging backdrop to fight an election. The Treasury simply hopes the OBR are wrong.

The OBR also says the investment allowances announced by Mr Hunt do not boost growth, they just bring the benefits earlier.

Indeed, there are big questions about how the benefits of this budget are distributed.

Abolishing the tax free pension allowance will cost £835m a year, yet will only benefit 10,000 of the very highest earners a year.

This is being presented as a measure to stop doctors from leaving the profession, but doctors are only in this category because – like senior Whitehall officials – they have gold-plated pension schemes, meaning they are likely to accumulate pensions of over £1m. This will also be true of corporate titans but few others.

The other striking reform in this budget is to get more people into work, with changes that will affect parents, people with disabilities and introducing more rigorous sanctions for benefit claimants who do not take up reasonable work offers or increase their hours.

Pension changes are also designed to help get people working for longer. This is a substantial part of the government’s tale about the benefits of today’s budget.

The scale of the problem is stark: in the budget speech, Mr Hunt said this was because while there are one million vacancies, there are seven million people not working.

Yet the OBR is deeply sceptical that today’s set of policies will have anything like a transformational difference.

The OBR forecast these measures will only increase the labour market by 110,000 by 2027 – dealing with a fraction of the problem.

This may be the biggest adjustment they’ve made because of labour market reforms – it’s still just not very big.

Today Mr Hunt was able to say that Britain has avoided a technical recession. The question is whether voters feel the benefits fast enough.