Artificial intelligence will be the biggest bubble of all time, according to the CEO of open-source AI company Stability AI.

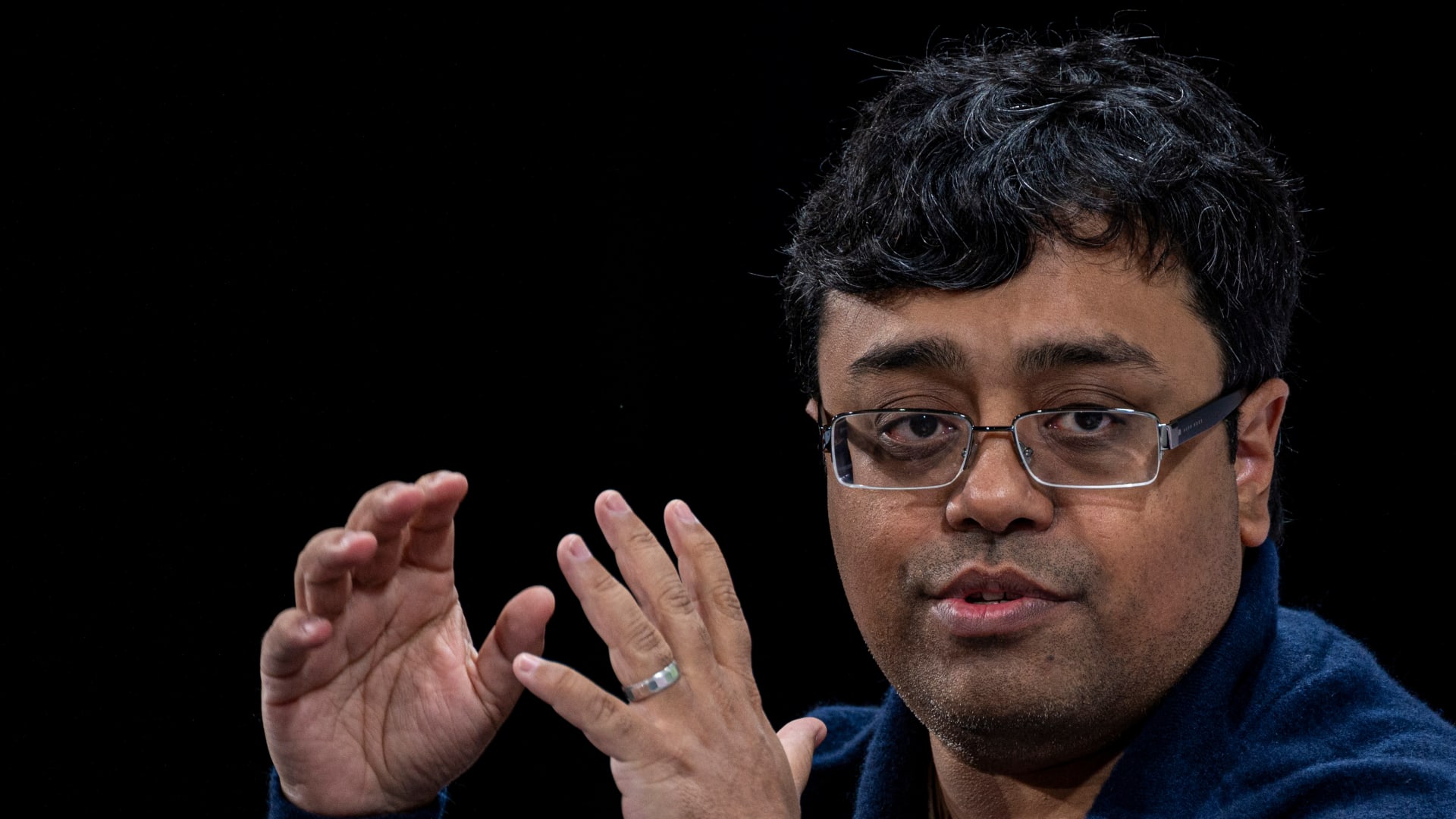

Speaking with UBS analysts on a call last week, Stability AI CEO Emad Mostaque said of artificial intelligence: “I think this will be the biggest bubble of all time.” He added that it is still at the very early stages and not ready for mass-scale adoption in industries like banking just yet.

“I call it the ‘dot AI’ bubble, and it hasn’t even started yet,” he said.

Stability AI is the company behind Stable Diffusion, one of the other more popular generative AI tools aside from OpenAI.

Stable Diffusion allows users to generate photo-realistic images by inputting text. It has more than a million users and has raised over $100 million from investors including Coatue and Lightspeed Venture Partners.

Mostaque, its co-founder and CEO, has been accused of making misleading claims about his background, achievements, and partnerships. He disputed the claims one by one in a detailed response on his personal blog.

Generative AI has captivated the imagination of many an academic, boardroom executive, and even school student, for its ability to produce humanlike language and visual content from scratch in response to user prompts by using vast amounts of data.

AI has long been around, with the technology now a common feature of online browsing, social media platforms, and home assistants. Beyond consumer applications, the technology is being used in medicine, transportation, robotics, science, education, finance, defense, and other industries.

However, a more novel form of AI which has come about recently is generative AI, which is used in tools such as the popular AI chatbot ChatGPT, from U.S. tech firm OpenAI, as well as Google Bard and Microsoft Bing Chat, and image generators like Dall-E, Stable Diffusion, and Midjourney.

Mostaque said that the total amount of investment needed in AI was likely to be $1 trillion “because it’s more important than 5G as infrastructure for knowledge,” and suggested banks like UBS would have to adopt the technology as it is a “massive market.”

But, he added, it is at the “early stages” of development right now.

“It’s not quite ready” to be deployed at scale within large industries like financial services, “but we can see the value,” Mostaque said.

Mostaque said that companies that do not use AI appropriately in their businesses will be “punished” by the stock market.

He cited the example of Google, which lost $100 billion in a single day after its Bard AI chatbot gave inaccurate information in a promotional video upon its release. Google is competing aggressively with Microsoft to win in the race to build superior AI tools.

“I think this is real. I think that there aren’t many investable opportunities here, and you’ll see people moving from the best chip manufacturers to companies that are using this to impact their bottom line and their top line appropriately. And you will see the market punishing those that don’t use this,” Mostaque said.

“This will be one of the biggest investment themes over the next few years,” he added.

WATCH: Inflection A.I.’s Reid Hoffman: A.I. is the new industrial revolution, the ‘cognitive revolution’