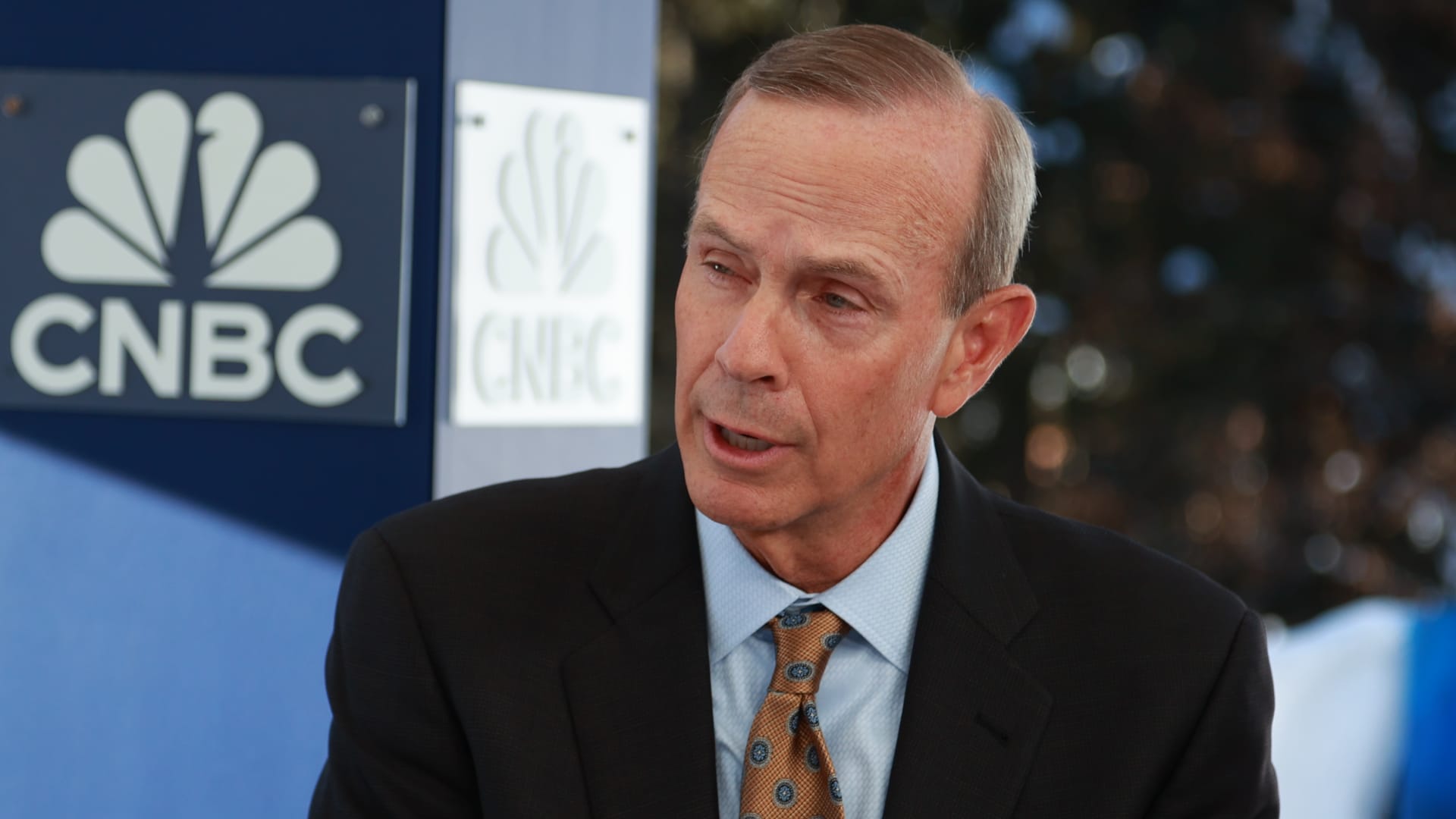

The crisis in the Red Sea poses serious risks to oil flows and prices could change quickly if tensions lead to a major supply disruption in the Middle East, Chevron CEO Michael Wirth told CNBC on Tuesday.

“It’s a very serious situation and seems to be getting worse,” Wirth said in an interview at the World Economic Forum in Davos, Switzerland.

The Chevron CEO said he was surprised that U.S. crude oil was trading below $73 a barrel because the “risks are very real.”

“So much of the world’s oil flows through that region that were it to be cut off, I think you could see things change very rapidly,” Wirth said.

Chevron has continued transporting crude through the region as the company works closely with the U.S. Navy’s Fifth Fleet, Wirth said. The CEO cautioned that situation is evolving.

“We really have to watch very carefully,” Wirth told CNBC.

Shell suspends Red Sea shipments

The British oil major Shell has suspended shipments through the Red Sea, people familiar with the matter told The Wall Street Journal Tuesday. Shell declined to comment in response to a request from CNBC.

Shell’s decision to halt shipments through the crucial trade chokepoint comes about a month after BP paused transits through the Red Sea. Several major tanker companies, which transport petroleum products such as gasoline as well as crude oil, halted traffic toward the Red Sea on Friday.

Houthi militants, who are based in Yemen and allied with Iran, have repeatedly attacked commercial vessels in the Red Sea in response to Israel’s war in Gaza. The U.S. and Britain have launched airstrikes against Houthi targets in Yemen to secure shipping through the waterway.

The Houthis have continued to launch attacks despite the U.S.-led strikes. The militants on Tuesday launched an antiship ballistic missile that struck a Maltese-flagged bulk carrier in the Red Sea, according to U.S. Central Command. No injuries were reported and the vessel continued to transit the waterway, according to CENTCOM.

Sullivan: Houthis are hijacking the world

U.S. National Security Advisor Jake Sullivan said nations with influence in Iran need to take a stronger stand to demonstrate the “entire world rejects wholesale the idea that a group like the Houthis can basically hijack the world as they are doing.”

The U.N. Security Council adopted a resolution last week condemning the Houthi attacks “in the strongest possible terms.” Permanent council members China and Russia, which wield veto power, abstained from the vote on the resolution.

“We anticipated that the Houthis would continue to try to hold this critical artery at risk, and we continue to reserve the right to take further action, but this needs to be an all hands on deck effort,” Sullivan said during an interview in Davos on Tuesday.

Oil market and geopolitical analysts say that the biggest risk to energy supplies would come if Middle East tensions erupt into a regional conflict that disrupts crude oil flows out of the Strait of Hormuz.

Some 7 million barrels of crude oil and products transit the Red Sea daily, compared to 18 million barrels that transit the Strait of Hormuz, according to data from the trade analytics firm Kpler.

Goldman Sachs has warned that a prolonged disruption in the Strait of Hormuz could double oil prices, though the investment bank views that scenario as unlikely.

Wirth said Chevron had two ships attacked by the Iranian Navy last year, one of which was hijacked by commandos and taken to an Iranian port and the other took fire for four hours until the U.S. Navy intervened.

Iran seized an oil tanker last week in the Gulf of Oman. The Marshall Islands-flagged tanker St. Nikolas was previously involved in a dispute between the U.S. and Iran over sanctioned crude.