Rivian’s (RIVN) stock is down after a “pivotal” Q2 earnings. Although it wasn’t enough to convince investors, Rivian’s CEO is defending the EV maker’s progress over the past few months as it preps for its next growth stage. Here’s what Rivian’s CEO, RJ Scaringe, had to say.

Rivian’s stock tumbles following Q2 2024 earnings

After shutting down its Normal, IL plant for upgrades in April, Rivian’s production slipped in the second quarter while deliveries remained flat.

Although this was expected, investors are not convinced of (or have not fully digested) the changes.

Rivian released its Q2 2024 earnings report Tuesday with $1.15 billion in revenue, meeting Wall St forecasts. Despite this, Rivian’s losses widened slightly to $1.46 billion, or $1.46 per share, compared to a $1.2 billion ($1.27 loss per share) in Q2 2023.

After making “Significant progress driving greater cost efficiency, improving its products, and further strengthening its balance sheet” in Q2, Rivian still lost $32,705 on every EV build.

| Q3 ’22 | Q4 ’22 | Q1 ’23 | Q2 ’23 | Q3 ’23 | Q4 ’23 | Q1 ’24 | Q2 ’24 | |

| Rivian loss per vehicle | $139,277 | $124,162 | $67,329 | $32,594 | $30,500 | $43,372 | $38,784 | $32,705 |

Although that’s an improvement from Q1’s $38,784 loss, it’s still up slightly from the $32,594 loss in Q2 2023.

Rivian’s investors were apparently not impressed with stock prices tumbling over 5% on Wednesday. Rivian’s shares are down 42% over the past 12 months.

Light at the end of the tunnel

Despite the wider loss, Rivian reaffirmed all guidance, including achieving its first gross profit by the end of the year.

“We need to aggressively drive towards profitability,” Scaringe said on the company’s Q2 earnings call. Rivian expects a modest gross profit in the fourth quarter of 2024.

The biggest reason behind Rivian’s confidence is the drastic changes taking place in Normal. Scaringe explained that the company’s plant upgrades are a “pivotal” moment. Rivian cut out 100 steps from battery making, 50 body shop components, and 500 parts from design.

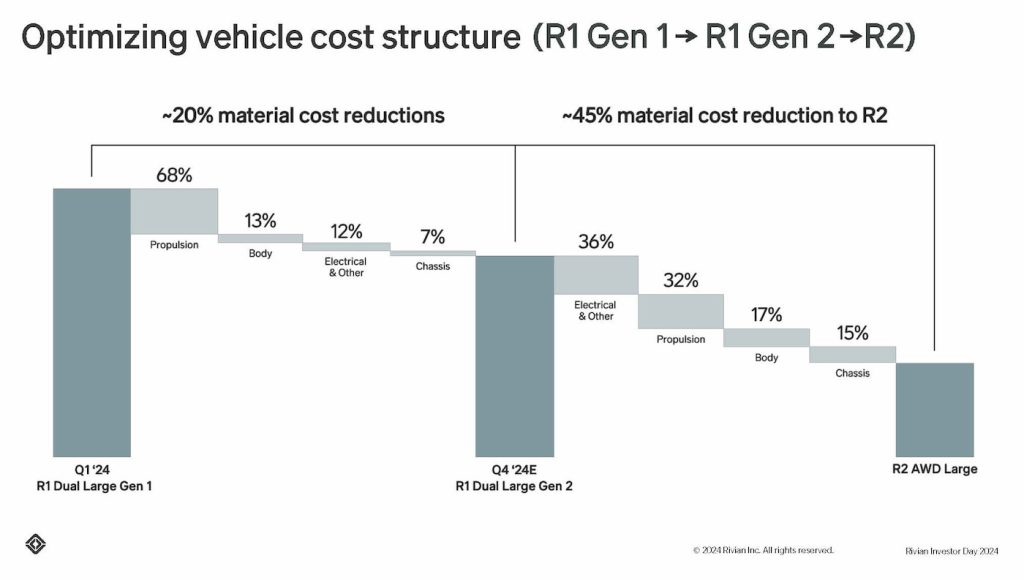

After introducing new tech, more efficiency, and improving supplier contracts, Scaringe believes they will enable “significant material cost reductions.”

Rivian introduced its second-gen R1S and R1T earlier this summer. The second-gen models have been re-engineered to cut costs. For example, 65 parts and nearly 1,500 joints have been eliminated. Following the upgrades, Rivian expects a 30% improvement in the R1 production line rate.

With new in-house motor configurations, Rivian is seeing dramatic cost improvements. Its new Ascent Tri motor costs 32% less than its Origin Quad, while the Ascend Quad costs 24% less.

The next generation

The new technology will serve as the foundation for Rivian’s next-gen R2. Rivian expects to begin R2 production in Normal in early 2026.

Starting at $45,000, the R2 is nearly half the cost of Rivians R1S and R1T. Rivian’s flagship R1 models helped establish it as a true premium EV maker, but R2 will open it up to the mass market.

Scaringe said the R2 is “Worlds different” from Tesla’s Model Y as it looks to grab a share of the surging mid-size SUV market.

Rivian’s R2 already has “well over 100,000” pre-orders and climbing, according to Rivian’s Vice President of Manufacturing Tim Fallon.

Once R2 production begins, it will account for the majority of Rivian’s output. Rivian plans to build 155,000 R2 models annually and about 85,000 R1S and R1Ts in Normal.

Speaking with Bloomberg following Rivian’s Q2 earnings, Scaringe defended the company’s progress despite the stock slipping.

Scaringe explained the improvements and new tech Rivian introduced will help drive down costs. The ultimate goal is to reach profitability. However, Scaringe said, “the biggest singular step” Rivian has made so far was in Q2.

Rivian’s CEO believes the upgrades will “take us to a place where the incremental contribution of every vehicle we sell is positive.” And that’s what Rivian expects to reach in the fourth quarter.