As Europe pushes to phase out fossil fuels, a new study finds that, ironically, the EU is pouring billions of dollars a year into subsidizing ICE company cars – to the tune of $42 billion ($45.60 billion) a year. How is this even legal?

According to a new study, the European Union is heavily subsidizing the purchase of new fossil fuel company cars – by $42 billion ($45.60 billion) a year. In Europe, company cars comprise around 60% of new car sales.

In a new study, as reported by Reuters, consultancy Environmental Resources Management (ERM) found that the EU’s five biggest members spend €42 billion ($45.60 billion) annually subsidizing fossil-fuel company cars. Environmental group Transport & Environment (T&E) calls for more subsidies for EVs instead.

To break down the spending, Italy provides €16 billion in subsidies for fossil-fuel company cars, followed by Germany, which provides €13.7 billion. France chips in €6.4 billion, while Poland pays €6.1 billion annually.

Around €15 billion across the four countries goes to subsidizing SUVs, the study found. In turn, company car drivers receive annual tax benefits of €6,800, “ranging up to €21,600 for high-polluting larger models,” Reuters reports.

“This is completely illogical and completely unacceptable, that we’re still pouring billions of taxpayer money into a technology that’s completely contradictory to the European Commission’s green transition agenda,” T&E’s director of fleets Stef Cornelis told Reuters.

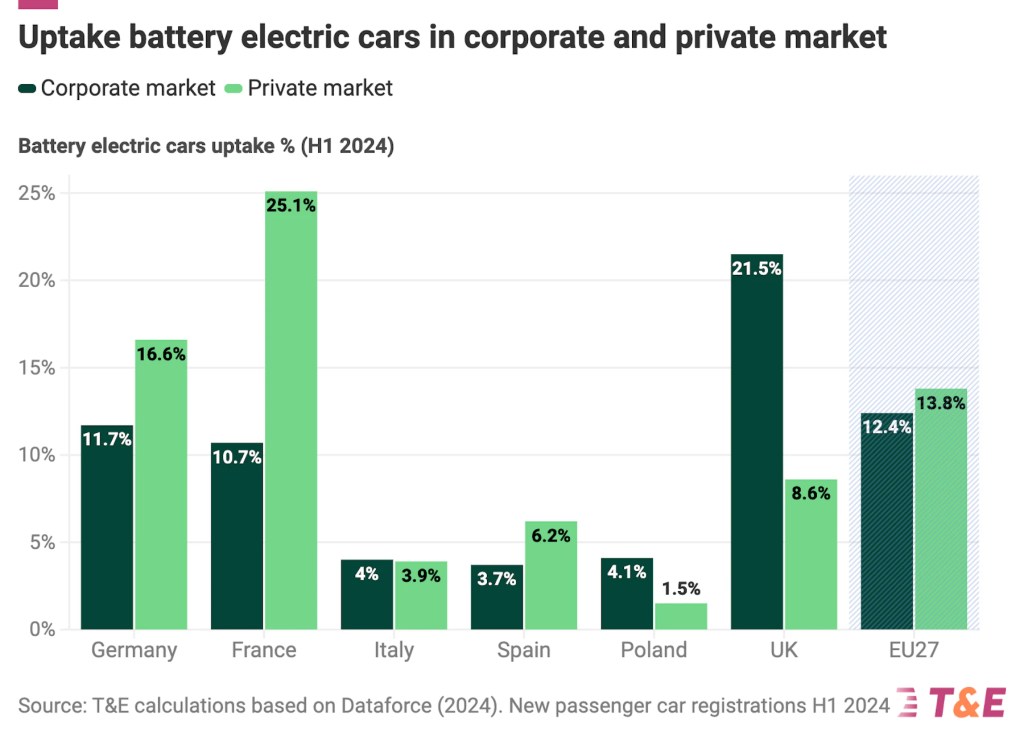

The biggest subsidy happens via benefit-in-kind schemes that continue to incentivize petrol and diesel vehicles, reports T&C. But tax advantages for ICE cars in the UK and Spain are much lower, with the UK imposing a strong penalty for petrol and diesel company vehicles through a high benefit-in-kind rate, while electric company car drivers pay lower taxes. The result: a boost in the uptake of electric company cars, which is now at 21.5%. In Spain, the tax benefits for company cars are similar to those for private vehicles, primarily due to a relatively high benefit-in-kind rate. But as Spain offers minimal incentives for companies to opt for electric cars, the uptake of corporate EVs is only at 3.7%, T&E reports.

Meanwhile, EV sales in Europe have dropped, with sales of BEVs dipping 44% in the EU in August. Germany, the largest EV market, reported a decline of 69%, while France saw a drop of 33%, according to industry data reported in Reuters.