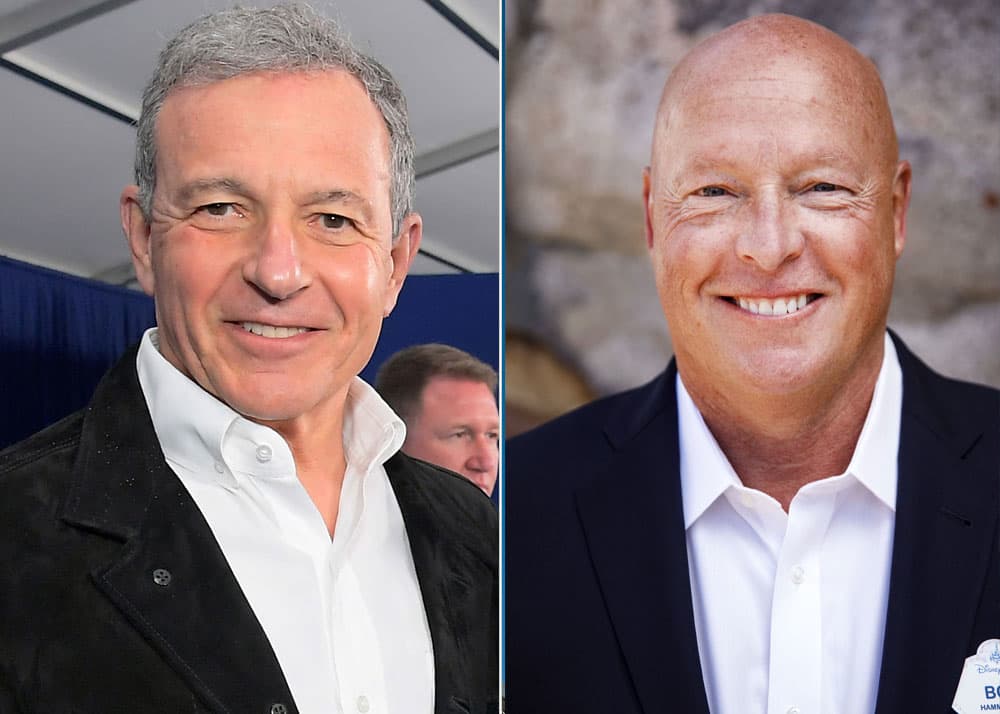

Bob Iger, left, and Bob Chapek of Disney

Charley Gallay | Getty Images; Patrick T. Fallon | Bloomberg | Getty Images

There are Boomers, Millennials, Generation X, Y and Z. There should also be a name for “media company CEOs that took over in 2020.” I’ll call them: The Shepherds.

That’s a lot of turnover for fewer than nine months. What’s going on here?

Clearly, the media industry is in a state of transformation. The main shift is highlighted by traditional media companies reorganizing for a world of streaming video. The cable/pay-TV model — a mutually beneficial system for cable companies and cable networks for about four decades — is eroding.

This new class of CEOs have one major goal: get consumers adjusted to consuming and paying for digital video while artfully winding down the cable bundle. This has started already, but the transition may take the entire decade.

The golden goose: the pay-TV bundle

The pay-TV business has been a reliable cash cow for about 40 years. Through economic ups and downs, leading to expansions and contractions in advertising budgets, the subscription cable TV model has been a steady flow of cash from the pockets of consumers to the coffers of media companies.

“People would sooner unplug their refrigerators than their cable boxes,” telecommunications analyst Craig Moffett used to say.

Programmers have consistently raised prices on distributors. Those costs have been passed on to consumers. That’s part of why the industry is now changing — the cable bundle became too expensive and out of whack from a price-value standpoint to what Netflix and Amazon Prime Video were offering. Customers revolted. Tens of millions of American households have cut the cord on cable TV in the past few years.

The price increases were celebrated by media CEOs, who viewed their ability to hike costs on pay-TV distributors, such as Comcast, DirecTV and Dish, as evidence of their content’s value. Sometimes, attempts at raising prices led to blackouts, when distributors would push back. But even those disagreements would usually quickly be resolved, leading to higher prices.

That’s led to some obscenely high CEO pay packages that persist year after year. Iger made $47.5 million in 2019 and $65.6 million in 2018. Burke made $42.6 million in 2019. Stankey made $22.5 million last year. Discovery CEO David Zaslav made $45.8 million, a precipitous drop from the mere $129.4 million he pulled in a year earlier. Joseph Ianniello, the CBS CEO who merged the company with Viacom, took in $125 million last year as part of severance to leave after the deal’s completion.

Shifting to streaming may be the end of a media Pax Romana that lasted several decades. Media companies largely didn’t fight against each other. Disney, NBCUniversal, Discovery, Fox, AMC Networks, Viacom — they were all part of the bundle. Whether you watched their networks or not, they were getting paid. There was no need to compete against each other, excluding behind-the-scenes bidding for content.

The next decade is likely to present more challenges and investor scrutiny than the previous three. The Streaming Wars mean that each media company will have to compete more directly against each other for consumers, who will likely only pay for a finite number of subscription video services.

The new class: Shepherds, not revolutionaries

That may be part of the reason we’re seeing a CEO exodus this year. Spending billions of dollars on new content for streaming products that may or may not succeed (at least, in the cases of NBCUniversal, ViacomCBS and WarnerMedia) is a far riskier proposal than the cable model. If it works, it’s possible investors will reward these new CEOs with surging stock prices that closer mirror Netflix’s trading multiple.

It’s also possible investors will continue to value media companies the same way they’ve been valued for decades. If that’s the case, more money spent and temporarily lower EBITDA could equal slumping stocks.

Another reason for the mass exodus may be age. Iger is nearly 70 years old. Burke, Freer and Greenblatt are 60 or older. It’s not just that these CEOs are reaching retirement age — it’s that their usage of media probably differs from their target (younger) audience.

What’s notable is the replacements aren’t millennials. Kilar and Hopkins are about 50. Shell is 54. Chapek, Sarnoff and Mayer are all near 60. That’s still strikingly different than what we see among some of the biggest consumer-facing technology companies, where founder/CEOs like Facebook‘s Mark Zuckerberg, Snap‘s Evan Spiegel and Airbnb’s Brian Chesky are all in their 30s and Twitter‘s Jack Dorsey is 43. Only new Hulu president Kelly Campbell is even in the ballpark, at 42.

The age of the new media CEOs suits their role. The outgoing class of CEOs have built the foundation for a new media world by developing applications and setting investor targets for the next few years. In that sense, some of the hard work has actually already been done.

New CEOs will be more like shepherds and less like revolutionaries. They’ll have to guide their own employees, shareholders and consumers into a new way of valuing, monetizing and consuming media. They won’t have to build new systems from the ground up.

“I think there will be a bundle,” Kilar told Bloomberg’s Lucas Shaw this week. “If you could go back in history and start things fresh, you’d give customers a choice of à la carte and bundle. The bundle offers more value, but having an à la carte option is also lovely. We don’t get the luxury to go back in time. You will see a continuation of the bundle that has most of the major sports.”

New York Times outgoing CEO Mark Thompson (another media CEO who is leaving!) said this week that he’d be surprised if there’s a physical paper in 20 years. But he also pointed out that more than 900,000 people still paid for the paper, which is profitable seven days a week even without any advertising.

That statement is a microcosm for the entire media industry. The old business works, but it’s obviously dying and needs to change. The new business has major growth potential that can reinvigorate media stocks. But, for the next decade, both businesses will need to survive next to each other.

The results will be awkward.

Disney may push forward with streaming while keeping ESPN exclusive to a cable bundle until subscribers fall so much that it’s no longer profitable. NBCUniversal will keep Peacock free while its cable networks continue to churn out profits, but it will also reorganize the company to prepare for a streaming world instead of the bundle. WarnerMedia will have to solve its confusing branding around HBO Max and DirecTV. Both NBCUniversal and HBO Max will need to hammer out carriage deals with Roku and Amazon Fire TV.

It’s going to be a period of transition. If it’s done right, the next class of CEOs — people who are probably in their 30s today — could again be set up for decades of success. If it’s done incorrectly, well, just Google what happened after the Roman Pax Romana.

WATCH: CNBC’s full interview with WarnerMedia CEO Jason Kilar