Financial markets have been rocked this week by a battle initiated by ordinary people against those who are usually dubbed market manipulators – hedge funds.

This is not being fought on trading floors but online and is a consequence of an explosion in the popularity of amateur share trading by armchair investors and collaboration among them.

Here, Sky News explains what has happened to rattle market regulators, hedge fund short-sellers and even the providers of the zero-commission online trading platforms people are using.

How did this come to light?

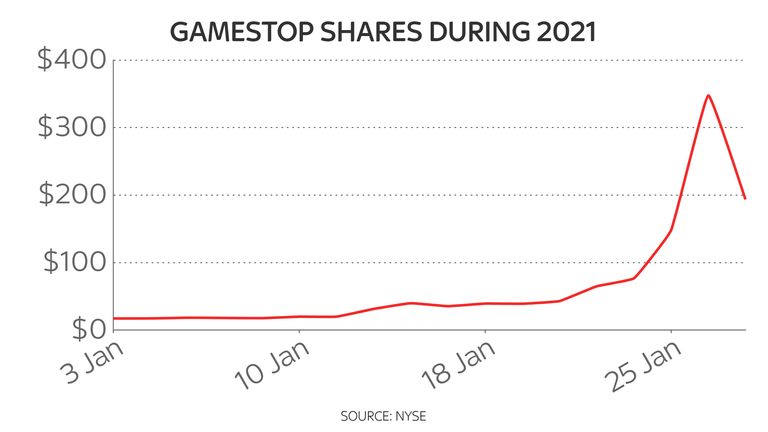

Unusual market activity was first linked to a surge in the share price of GameStop.

The reason why is that, this is a struggling US retailer that has been closing stores at pace over the past few years because of weak trading and the company had said nothing to indicate a sudden shift in its fortunes.

Shares, which had been trading at under $20 a pop, were suddenly hitting values around $350.

While it is down on earlier peaks, there remains high volatility over its market value.

Who was behind the value explosion?

Here is where the army of amateur investors enters the stage.

The stay-at-home message demanded of people during the coronavirus crisis, coupled with rock bottom interest rates, has inspired millions to seek out new ways to make their money work better for them.

It has seen the likes of online trading platforms such as Robinhood and Trading212 become immensely popular.

What users have been doing is collaborating on social media platforms, including Reddit, to conspire against the activities of hedge funds by using traded options, a product giving the holder the right to buy an asset at a fixed price.

The surge in price has been exacerbated by automated algorithmic trading, which can be triggered on big price shifts to cover a professional trader’s position.

What are hedge funds and why have they lost out?

These market participants are described as accurate forecasters of stock market returns by academics and market manipulators by critics.

The companies engage in a practice known as short-selling.

Short-sellers borrow shares and immediately sell them, betting the price will drop before they buy back the shares and return them, pocketing the difference.

The GameStop stock was heavily shorted so when the price rose, the traders lost their bets and faced losses.

Does it matter that hedge funds have suffered so badly?

No. Unless you are a hedge fund manager.

The concern here among regulators is abnormal functioning of markets, usually based on information, becoming a risk to financial systems through disinformation and muddied motives of social media chatroom users.

The wallstreetbets board on Reddit alone has over four million members.

What are the other implications?

The activism is clearly spreading.

While dozens of other heavily-shorted stocks have been targeted there are clearly elements of the activist community intent on bringing down hedge funds – with death threats even reported.

On the other hand, commentators and notable US politicians, including Republican senator Ted Cruz, are suggesting that many are just playing Wall Street at its own game.

Mr Cruz accused Robinhood of keeping out the “little guy” when it implemented a trading freeze.

How are the trading platforms now suffering?

The likes of Robinhood may have benefited from surging customer numbers by the day but the trading frenzy has created its own problems.

Many, such as Trading212 on Thursday, have had to suspend new customer applications and stop users buying more shares in companies including GameStop to the fury of investors.

Platform outages have been widespread and the New York Times reported on Friday that Robinhood had had to raise more than $1bn in emergency funding to prevent further limits on customer trades.

In short, they are a victim of their own popularity.