HSBC’s profits have surged by a better than expected 79% to $5.8bn (£4.2bn) in the first quarter, largely thanks to an improved economic outlook in the UK.

The upturn allowed the banking giant to release $435m (£313m) that had been set aside to cover bad debt, boosting its bottom line despite a squeeze on revenues caused by low interest rates.

HSBC had put aside a total of $8.8bn (£6.3bn) over the course of last year, including just over $3bn (£2.2bn) in the first quarter, as the pandemic took hold of the global economy.

The bank said that the reduction in expected credit losses (ECL) at the start of this year was “due to an improvement in the forward economic outlook, mainly in the UK”.

It also saw a $3.9bn (£2.8bn) increase in mortgage lending across the group, including $2bn (£1.4bn) in the UK. The group’s HSBC UK arm enjoyed a profit of $1bn (£700m) during the period.

“We are more optimistic than we were back in February, we expect GDP to rebound in every economy in which we operate this year,” chief executive Noel Quinn told Reuters.

He cited the successful rollout of vaccines in the US and Britain as a key factor.

But Mr Quinn also warned that uncertainties remained.

The bank said: “There remains a high degree of uncertainty as countries emerge from the pandemic at different speeds and as government support measures unwind.”

HSBC highlighted an array of risks posed by the pandemic ranging from renewed outbreaks as well as tensions over access to vaccines.

It also pointed to risks from frayed relations between China and the West and “dampened” business sentiment in some parts of the Hong Kong market – where HSBC, which has a base in the territory, has been criticised over its stance in relation to a political clampdown by Beijing.

Brexit also remains a worry and “may impact markets and increase economic risk, particularly in the UK”, HSBC said, though it also pointed to progress on talks aimed at easing cooperation between Britain and the EU in financial services.

The group also pointed to a planned hike in the UK corporation tax announced in last month’s budget, which it estimated would add about $150m (£108m) to its liabilities, plus the potential for a further hit from plans by Joe Biden’s tax plans in the US.

HSBC’s profits fell by 34% last year.

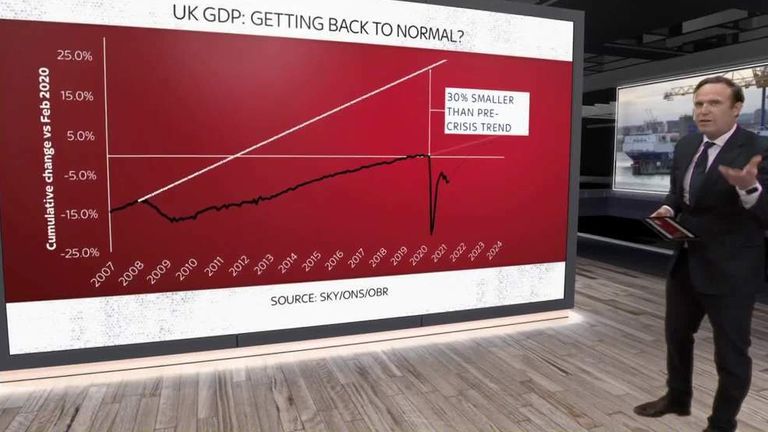

Its more optimistic outlook for the UK economy now comes a day after a forecast that GDP was on course for its biggest annual growth since 1941 this year.

That prediction, from the EY ITEM Club, was attributed to a more resilient than expected performance by business and consumers through latest lockdowns, and hopes for a big boost as restrictions are lifted.

Last year, the UK suffered its biggest annual economic decline in three centuries as GDP shrank by 9.8% thanks to the coronavirus crisis – the biggest fall among the G7 advanced economies.