In the words of the great Tom Lehrer, “Who’s Next?“

Now that AT&T has decided to separate WarnerMedia and merge with Discovery, the rest of the media world — particularly the smaller players — face new pressure to make their countermoves.

Even before this deal, it was clear that Lionsgate, MGM, Sony Pictures and AMC Networks were probably too small to compete in a streaming world where success depends on a massive store of content and global reach.

But ViacomCBS and Comcast‘s NBCUniversal are much bigger, and probably assumed they had some time — at least a year — to see how many subscribers signed up for their streaming offerings, Paramount+ and Peacock.

“Within the next two years, it’s going to be put up or shut up for all of us,” said David Zaslav, Discovery’s CEO who will take the top job at the combined company, in December. “Can you show you’re scaling? Are you going to be a player in the U.S.? Are you going to be a player around the world?”

Under pressure

That timeline is shorter now.

Suddenly, both ViacomCBS and NBCUniversal seem subscale compared as they attempt to put together global streaming services. They aren’t trying to be niche players, such as Starz or AMC+.

That means both will need more content to compete against Netflix, Amazon Prime Video, Disney and whatever the new name of WarnerMediaDiscovery will be.

The obvious move would be for ViacomCBS and NBCUniversal to merge. But a combined ViacomCBS/NBCUniversal would have two U.S. broadcast networks — CBS and NBC — housed under the same corporate roof. That won’t fly with U.S. regulators. While the parent companies could theoretically spin out or sell them, the broadcast networks provide so much value to both companies — and their streaming services — that it seems unlikely.

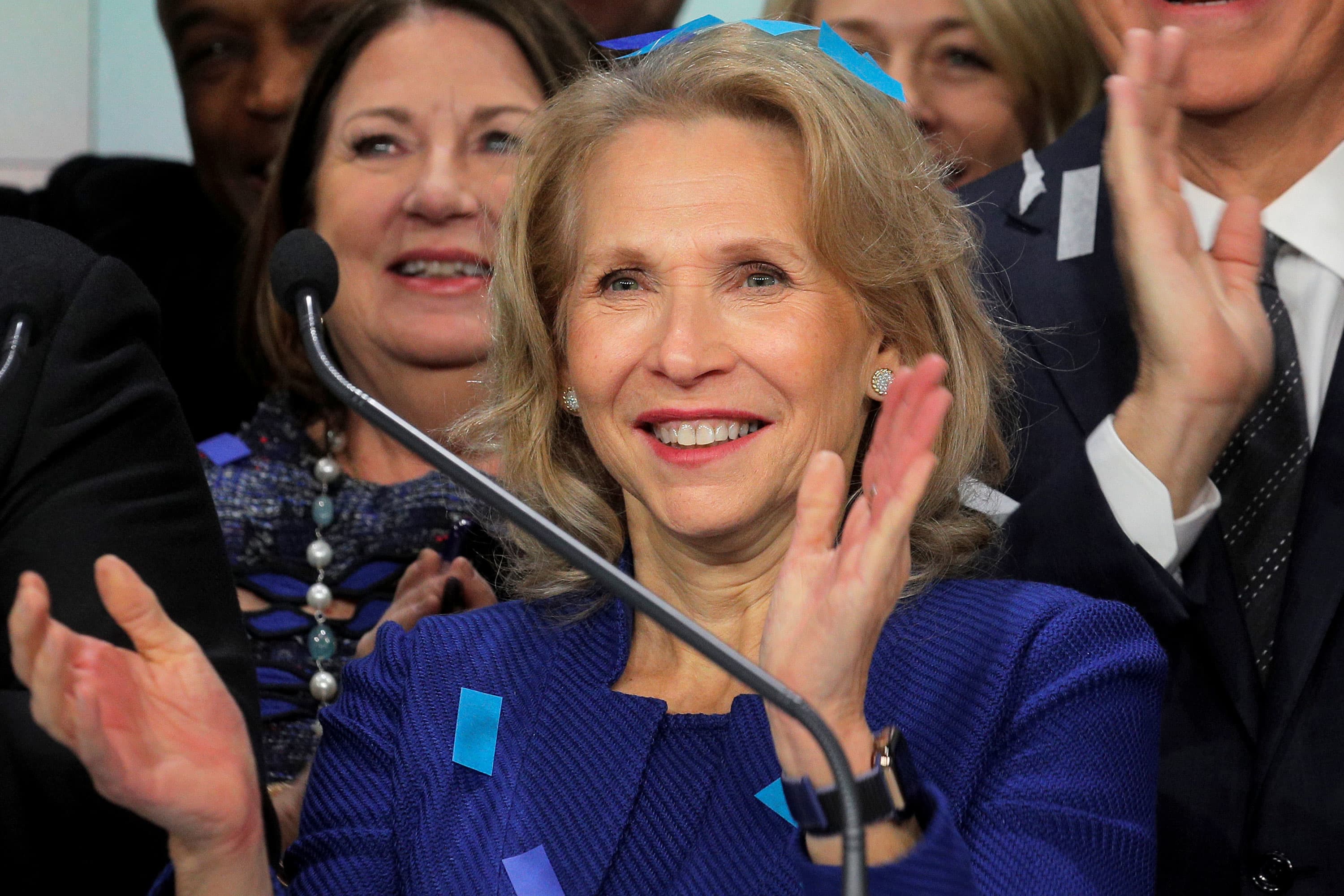

Further, Shari Redstone controls ViacomCBS and Brian Roberts controls NBCUniversal through his family’s Comcast shares. Their dual class share structure is another obstacle for both companies, as it makes it hard for outsiders to pressure the companies to make changes the executives don’t favor. But it’s not a deal stopper — Discovery had several classes of shares too, but John Malone was willing to eliminate his voting shares to get a deal done with WarnerMedia.

Four options

That leaves Comcast and ViacomCBS with four likely options.

Buy. If both companies feel their streaming services can compete around the world, they can go on global and domestic acquisition sprees. It may take several deals to get to a scaled position, as they piece together smaller U.S.-based assets and larger global media companies in Latin America and Europe.

Sell. They could also sell. Shari Redstone is more open to the idea of selling ViacomCBS than her father, according to people familiar with the matter. It’s unclear if Roberts would consider selling NBCUniversal. Potential buyers could include Amazon or the newly merged WarnerMedia-Discovery. Apple and Netflix continue to hover along the periphery, but neither company has ever shown much interest in making big media acquisitions.

Reduce their ambitions. The third option is to throw in the towel on being a global streaming service. Instead, NBCUniversal and ViacomCBS could license their content to other, larger streamers and wind down Paramount+ and Peacock if they fail to gain global traction.

Bundle. Option four is similar but less drastic. ViacomCBS and NBCUniversal could begin bundling their streaming services together or finding new streaming partners to increase global distribution through discounted offerings. The main problem with this strategy is it limits the upside for both companies, who won’t be able to compete with larger players for top content and breadth of programming.

The fifth option — inaction — is no longer a viable strategy. The pressure is on Roberts, NBCUniversal CEO Jeff Shell, Redstone and ViacomCBS CEO Bob Bakish to find exciting go-forward solutions for their companies.

Disclosure: Comcast owns NBCUniversal, the parent company of CNBC.

WATCH: What the WarnerMedia-Discovery deal could mean for the streaming wars