Markets around the world were rattled on Monday morning as they digested news that a Russian invasion of Ukraine could be imminent, dealing a blow to investors already nervous about rising inflation.

European indexes, including the UK’s FTSE 100, Germany’s Dax and France’s CAC 40, all fell several percentage points at the start of the week, while US futures are all down ahead of the market open later on Monday.

Companies with exposure to Eastern Europe, travel firms, and banks were among those hardest hit.

Britain’s armed forces minister told Sky News today that he was worried an invasion of Ukraine could happen soon.

“My fear is it is very imminent, that’s not to say it’s definitely going to happen,” said James Heappey.

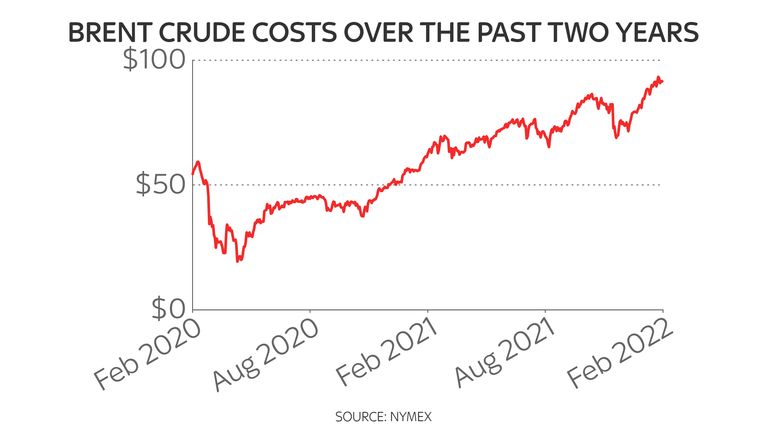

Oil prices also hit their highest level in more than seven years over concerns that a conflict involving Russia could disrupt fuel supplies from one of the world’s top producers.

Petrol prices, which hit a record high in the UK in December last year, are likely to be affected, adding to inflationary pressures in Britain.

Higher energy prices globally have already been a core reason behind the surge in UK inflation to a 30-year high.

Brent crude, the European oil benchmark, hit a peak of $96.16 early on Monday, its highest level since October 2014, after rising steadily for several consecutive weeks.

If Russia does invade Ukraine, “Brent crude won’t have any trouble rallying above the $100 level”, according to OANDA analyst Edward Moya.

“Oil prices will remain extremely volatile and sensitive to incremental updates regarding the Ukraine situation,” he added.

Markets are also responding to news on the tensions in Eastern Europe with volatility. The FTSE 100, Britain’s leading share index, fell by more than 2% on Monday morning, while equivalent indexes in France and Germany dropped by more than 3%.

In Asia, trading screens were also displaying a sea of red, with Hong Kong’s Hang Seng index down by 1.41%, and Japan’s Nikkei 225 down more than 2%.

US markets are expected to follow suit when they open on Monday afternoon, with pre-market trading already falling on all three of America’s major indexes.

“Global market sentiment has a decidedly fragile feel to it this morning as the Russian roulette situation continues to evolve over Ukraine,” Simon Ballard, chief economist at First Abu Dhabi Bank, said.

“Combined with already heightened unease over elevated inflation and the spectre of aggressive monetary tightening, we are now we are left on the defensive.”