The National Grid Electricity Systems Operator (ESO) has confirmed it will have no coal-fired power as back-up this winter, if needed, to help keep the lights on.

There were five contingency units to call on last winter as the energy market reeled from the impact of Russia’s war in Ukraine.

They were warmed up several times and used during March when a cold snap hurt wind generation.

The ESO had said earlier this month, at the publication of its early winter outlook report, that it remained in talks with EDF and Drax about keeping their coal-fired generation on its standby contracts.

But it said on Wednesday: “At the request of government in March 2023, the ESO has undertaken discussions with the operators of two winter 2022/23 contingency coal plants to establish whether these arrangements could be extended for a further winter.

“These discussions have now concluded. Both operators have confirmed that they will not be able to make their coal units available for a further winter and have begun the decommissioning process.”

That process was down to government policy.

It had said that by October 2021, all coal-fired power units were to have been shut as part of the country’s climate ambitions.

The remaining unit, Uniper’s Ratcliffe-on-Soar power station, will be the only one left functioning.

It has a so-called capacity market contract, meaning it will supply electricity to the grid like any other provider.

The unit had been solely available to the ESO last winter.

The lack of contingency back up is likely to alter the ESO’s outlook for the winter ahead.

Its earlier report expected sufficient capacity to meet demand after the turmoil leading up to 2022/23 when gas flows from Russia were stopped, sparking a scramble for supplies on the continent.

But it added that it was “prudent to maintain” the demand flexibility service (DFS), which was introduced in 2022.

The DFS, which was activated for the first time in January after a series of tests and false alarms, sees volunteer households paid to turn off their main appliances at times of peak demand.

Read more:

What is the demand flexibility service?

Households paid to save energy for first time as power supplies squeezed

The UK played a pivotal role in helping supply the continent with gas ahead of last winter amid a race to fill storage and stop the lights going out given historic dependency on Russian gas, particularly in Germany.

Britain, however, tends to import electricity from its North Sea neighbours during the winter months.

A relatively mild 2022/23 winter, coupled with alternative supply, meant Europe ended last winter with a record volume of gas in storage.

The report said of Britain’s electricity output: “We expect there to be sufficient operational surplus in our base case throughout winter.”

While the ESO is confident on the capacity issue, market experts still expect gas and electricity costs to go up over the colder months as demand spikes.

It could mean that household bills, through the energy price cap, start to rise again.

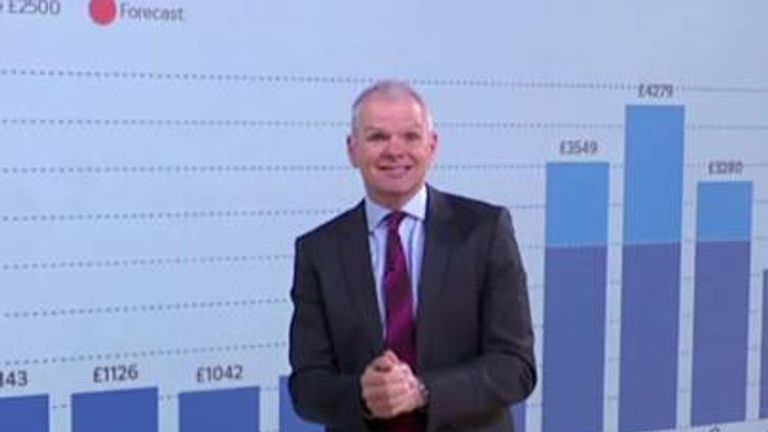

The cap kicks in again from July following the end of the government’s energy price guarantee that limited the wholesale prices that consumers faced.

The level of the cap, at just above £2,000 for the average annual bill, is well down on the £2,500 estimate under the guarantee.