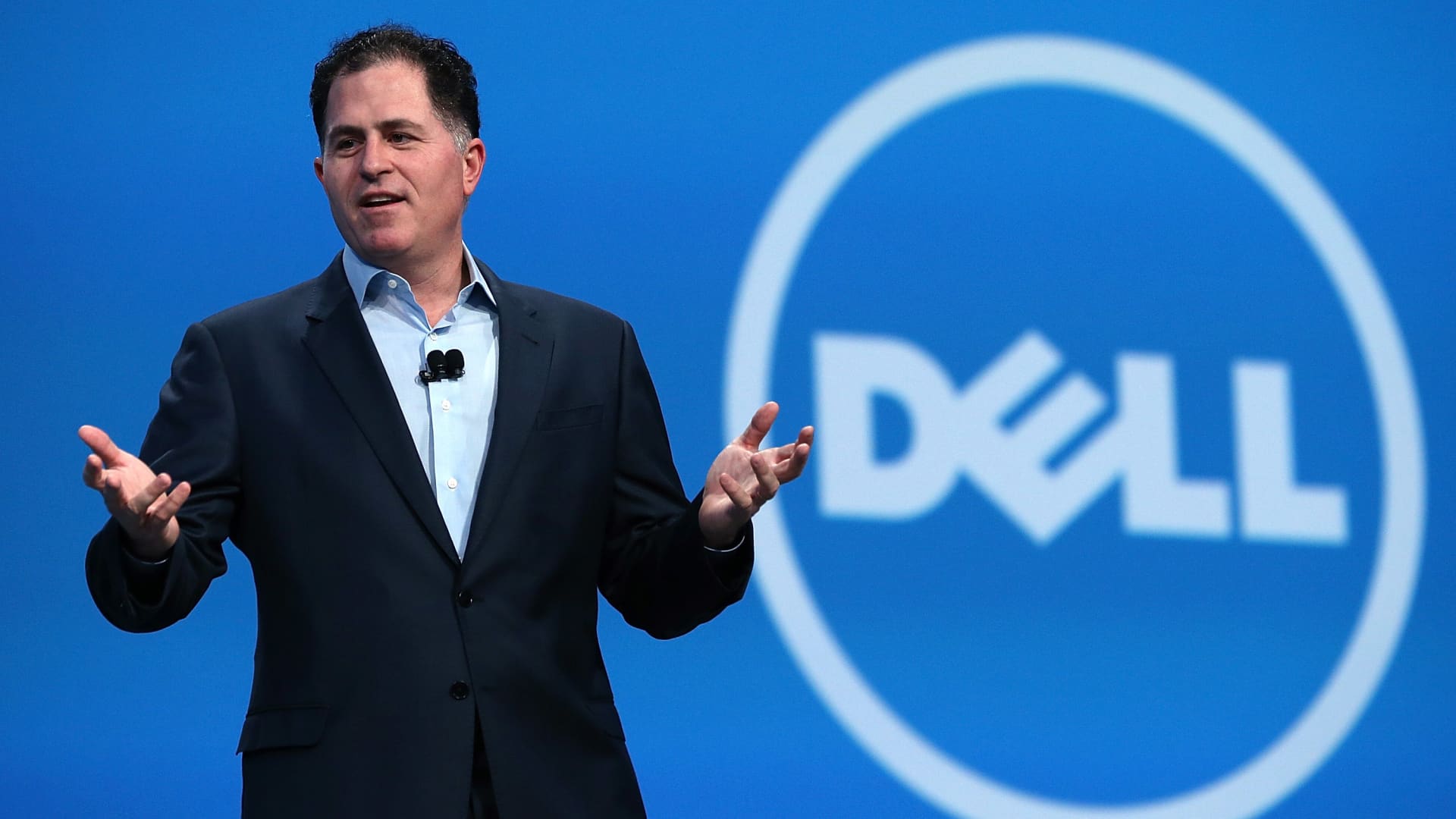

Dell is having its best day since founder Michael Dell brought the company back to the stock market in 2018.

Shares of the PC and server manufacturer surged 29% on Friday to $121.88, after the company posted fiscal fourth-quarter results that beat estimates. That tops the stock’s 21% gain from Sept. 1, which followed a better-than-expected earnings report.

For the latest quarter, Dell reported revenue of $22.32 billion, down 11% from the year-ago quarter but eclipsing the $22.16 billion analysts were expecting, according to LSEG, formerly known as Refinitiv. Adjusted earnings per share of $2.20 surpassed analysts’ estimate of $1.73. Dell’s net income of $1.16 billion marked an increase of 89% from its prior fourth quarter.

The company, demonstrating robust demand for its artificial intelligence servers, also said it’s increasing its annual dividend by 20% to $1.78 per share and expects revenue of between $21 billion and $22 billion for the first quarter.

Dell returned to public markets in 2018 after going private in 2013. Its market cap was about $16 billion when it first started trading over five years ago. It’s now worth close to $86 billion.

Morgan Stanley analysts reinstated Dell as a top pick on Friday and raised their price target to $128 from $100, writing in an investor note that the company’s “AI server commentary stole the show.”

“The strength of AI server orders, backlog, pipeline, and expanding CSP/enterprise customer base show DELL’s AI story is early days and gaining momentum,” they wrote.

Wells Fargo, citing Dell’s AI strength and dividend increase, hiked its price target to $140 and maintained an overweight rating, while Citi increased its target price to $125 and reiterated a buy rating.

— CNBC’s Michael Bloom and Ashley Capoot contributed to this report

WATCH: Friday’s rapid fire